A New Twitter CEO

Jack Dorsey has officially stepped down from his role as CEO of Twitter after spearheading the firm for eight years. He will be replaced immediately by Parag Agrawal, who previously served as the company’s chief technology officer.

Dorsey co-founded Twitter in 2006, and like Steve Jobs, was fired as CEO in 2008 before returning to the position in 2015. The firm is currently worth $33.6 billion.

In stark contrast to Agrawal, who has been described as a cerebral, technical manager, Dorsey is an eccentric character with libertarian views and interests in wellness and cryptocurrencies - the ‘silver-tongued Silicon Valley type’.

Besides Twitter, Dorsey also founded the payments company Square in 2009, which has a market cap of $83.6 billion. He still serves there as CEO.

The succession may have been planned long in advance if we consider that Elliott Management - a feared activist fund - had called for his replacement two years earlier, citing Dorsey’s dual positions at Twitter and Square as an issue.

In case you forgot, Twitter banned then-president Donald Trump from the platform in January, shortly after the Capitol Hill riots. Talk about a power play.

It’s fitting that Dorsey tweeted his resignation - notice the comments section.

I’ve always been confident that Twitter is something of a relic to younger generations. Nobody in my social circle uses the platform, and it’s unsurprising to me that the company has struggled to retain profitability over the last ten years.

Maybe we will see a complete revamp of Twitter? Next thing you know, users are actually under 50!

Glencore Activism

An activist fund named Bluebell Capital wants Glencore PLC - a commodities giant - to divest its thermal coal assets.

Bluebell claims that Glencore’s fossil fuel assets cause sustainability-oriented investors to scatter, resulting in a ‘carbon-discount’ being applied to the company’s shares. Per Bluebell’s letter to Glencore’s shareholders, which was seen by Bloomberg:

“Due to its coal business, Glencore is not an investible company for investors who place sustainability at the heart of their investment process.”

“A clear separation between carbonised and de-carbonised assets is needed to increase shareholder value and remove the ‘coal discount’, whilst simultaneously ensuring that coal assets will be managed responsibly.”

- Bivona & Taricco, partners at Bluebell Capital

Glencore’s current strategy envisages a gradual run-down of the thermal coal business over 30 years. These operations are incredibly lucrative, especially now that prices have shot up to record levels. The firm is expected to bring in $8.3 billion in profit on revenues of $215.5 billion in the 2021 fiscal year.

Bluebell is a notably small fund, with about $200 million in assets under management, but it has led successful campaigns against Danone and GlaxoSmithKline prior to this.

Bluebell’s move ties into a broader theme of activists wanting to alter the course of fossil fuel giants. Royal Dutch Shell and Exxon have been recent targets.

Chinese VIEs and Delistings

China’s growth potential is undeniable. This is particularly true in the internet sector; 1 billion Chinese citizens are now online. Foreign investors have always sought exposure to this phenomenon, but this has proven complicated in practice.

The Chinese government classifies foreign investment as either ‘encouraged’, ‘restricted’, or ‘prohibited’, depending on the industry in question. It’s no surprise that the internet industry falls under the label of ‘restricted’ - the strategic value of data is clear.

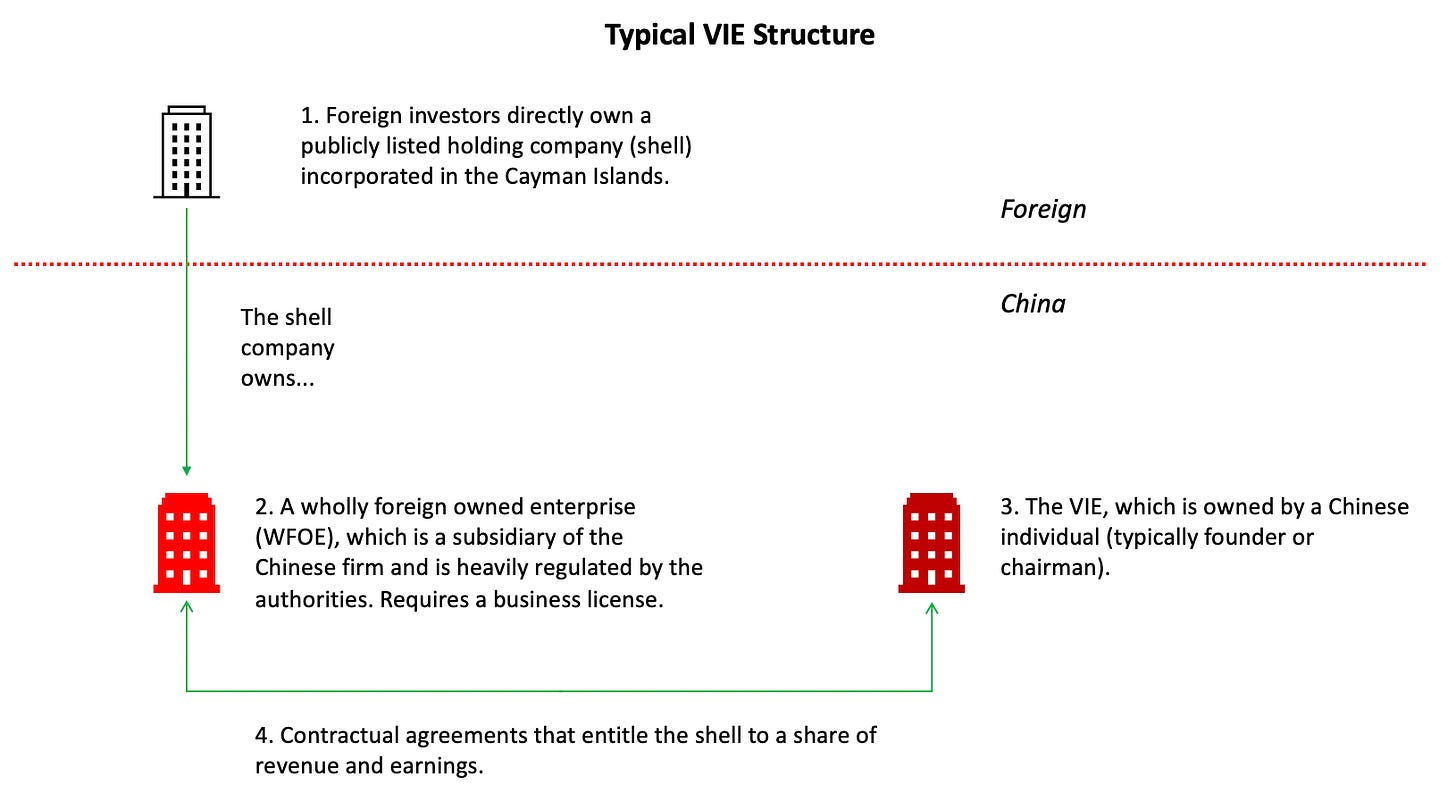

So how do foreign investors get in on the action? They can gain exposure via a complicated and exotic accounting structure known as variable interest entity (VIE).

In essence, a VIE entitles foreign investors to a share of the revenue and earnings of a Chinese firm via contractual agreements, but not direct ownership. All U.S. listed Chinese firms utilise this structure to attract capital, thus including tech behemoths like Alibaba and Tencent, although they may trade as American Depository Shares (ADSs) on U.S. exchanges.

It is unclear whether the VIE structure, although technically legal, is accepted as such by the Chinese authorities. The VIE was pioneered in the 2000 IPO of the Chinese media company Sina Corp. - pointing to a sustained tolerance of the practice - but it now seems that the government is reining it in.

Indeed, the Chinese ride-hailing firm Didi Global has been ordered to delist from the NYSE and re-list in Hong Kong due to governmental cybersecurity concerns.

Didi went public in June of 2021 against the will of Chinese authorities and without waiting for a required cybersecurity review. It was punished by having its app removed from stores only four days later.

The firm holds a monopolistic market share back in China and is a treasure trove of sensitive data. Its IPO has disappointed and the company lost $1.3 billion in its 2020 fiscal year.

Impending regulations from the U.S. side - initiated by Donald Trump - exacerbate the situation.

“If you want to issue public securities in the U.S., the firms that audit your books have to be subject to inspection by the Public Accounting Oversight Board [PCAOB].”

“While more than 50 jurisdictions have worked with the PCAOB to allow the required inspections, two have historically not: China and Hong Kong.”

- Gary Gensler, Chairman of the Securities and Exchange Commission

Chinese firms that do not comply with these rules could be booted off U.S. exchanges by 2024.

The negative news flow out of China is relentless, and this is reflected by the dismal performance of the NASDAQ Golden Dragon China index, which tracks U.S. listed Chinese firms that derive most of their revenue from their home market.

Top reads from this week:

“The race to decipher Omicron: will it take days, weeks or months?” (Financial Times)

“The inside story of the Pfizer vaccine: ‘a once-in-an-epoch windfall” (Financial Times)

“Opec+ sticks with oil supply increase after US overture to Saudi Arabia” (Financial Times)

“The Winds of Change” (Howard Mark’s Memos)