2022 Reflections & Performance

The Substack's progress up until now, portfolio performance, and future plans.

I wish all of you a happy and prosperous new year! Thank you for your continuous support.

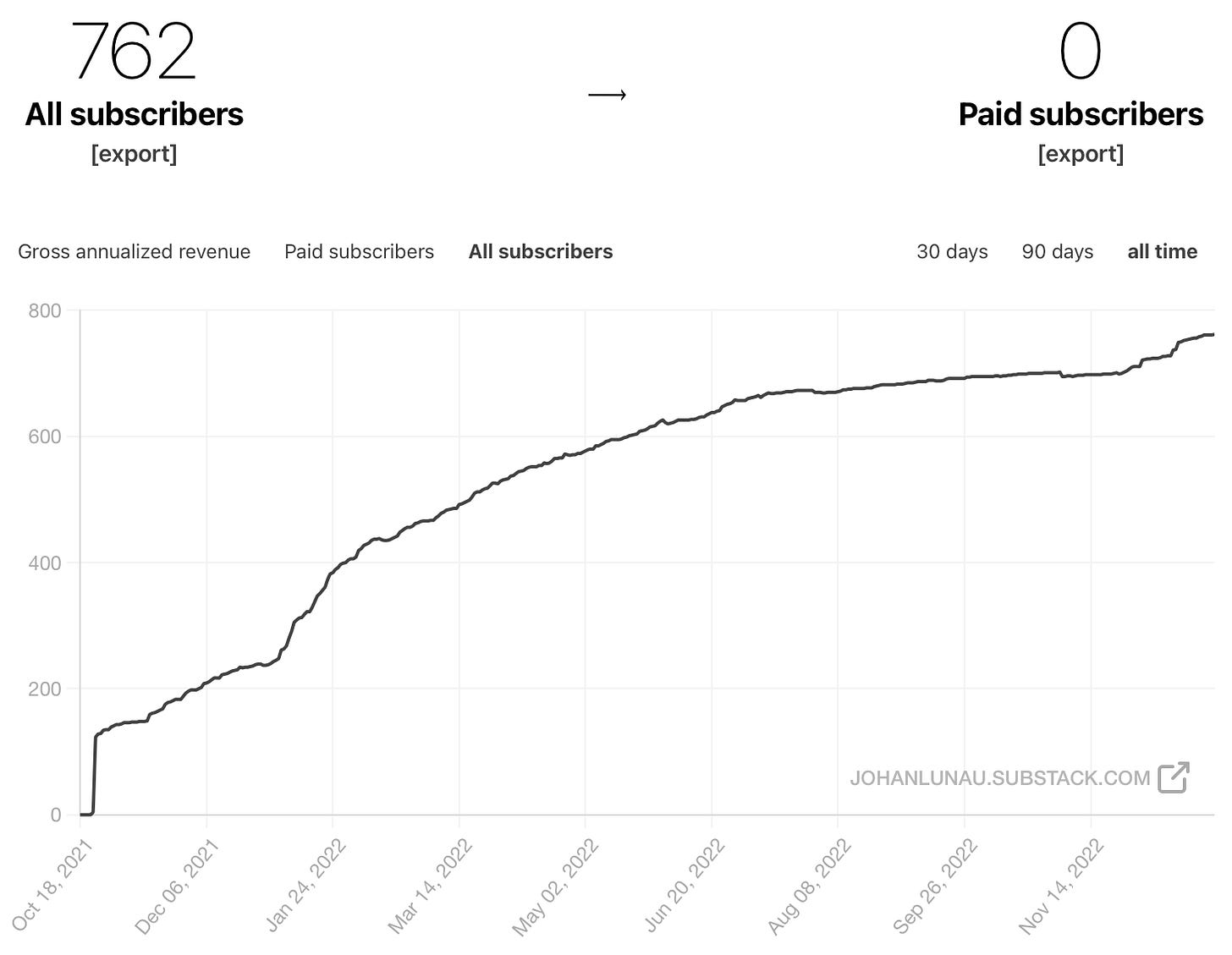

When I started this Substack in October 2021, I posted weekly, digestible updates on the biggest market developments, like rate hikes, major corporate events, and Elon Musk’s ridiculous antics. Also on the menu were lists of net-nets, which are companies that sell below the value of their net current assets i.e., their liquidation value (a Ben Graham approach).

But I soon lost interest in reporting financial news… I felt most of it was meaningless noise, and what I was passionate about was long-term investing. Moreover, the net-nets were almost all Japanese companies, known for hoarding cash and not putting shareholders first (stakeholder capitalism is great, but becoming an inefficient company is not). Often, I had to purchase at least 100 shares to trade these illiquid stocks – if they were available at all. Neither did I sleep well with such a contrarian portfolio filled with forever discounted companies.

I couldn’t maintain a free blog that didn’t gel with my interest of long-term investing. So I decided to publish investment ideas instead. I wanted to meet others who shared a passion for investing and learn from those who were better and more experienced than me. The CV boost was a bonus, too.

After uploading the first few pitches, I realized four things. First, a lot of people have immediate read/pass reactions. If an idea doesn’t match their approach, they feel uncomfortable and move on, regardless of the theoretical upside/downside ratio. I think that’s a good thing. The best investment strategy is one that you can stick with.

Second, informed, constructive criticism is rare, but super valuable. Top feedback from other investors uncovers omissions in one’s own work that must be addressed, or points out critical, overlooked thoughts. For example, I shared a link to the DOCS write-up in r/SecurityAnalysis, where someone pointed out that the appeal of Dr. Martens’ footwear might, in fact, decline with increasing sales: shoes and boots marketed as rebellious self-expression become the opposite once a majority of people wear them.

Third, there is a sweet spot for the length and detail of write-ups. Extracting and communicating the information core to a thesis is critical, but peripherical facts and figures are often superfluous and have a dilutive effect. In other words, the law of diminishing returns applies. An example of this is investigating management. Executives’ abilities are reflected in metrics like returns on capital and sales growth. Are these metrics excellent and were they produced by the current team? Then management is excellent (assuming a shareholder-first focus). Add compensation, strategies, and incentives, and the investigation can stop there. You don’t need a profile of each executive. However, if a new executive team has been shuttled in to turn around an ailing firm, their track records will form a core point in the thesis.

And last but not least, if an idea doesn’t seem obvious, make the decision to pass on it. There’s lots of opportunities out there if you look in the right places, and time is valuable. Stick with one-foot hurdles.

Now to the performance of the picks uploaded so far. Choice of the index benchmark reflects the characteristics of the companies (primarily mid-caps in developed markets).

Whilst this blog does not provide investment advice, it feels good that the picks eked out a gain of 6% in 2022, a period when the benchmark lost 21%. I’m not naive about the nature of returns, however. Performance is indicative across, perhaps, a 5-year period at a minimum.

For the future, I plan to improve the pitches more, and to find some more special situations. I’m also thinking of adding newer content, which could include things like portfolio updates, a podcast, thought pieces, and the attachment of models and financials (some of this will be under a paid tier offering as an incentive to me). But this depends on the time I have available. I’ll be starting an equity research internship in mid-Jan, so don’t be surprised if there’s a short downturn in posts during that period.

Before I go, I would love to get a better idea of your satisfaction with the investment ideas so far and eagerness to see new content. Please indicate your answers in the poll below. All the best for 2023, and thanks again for your enduring support.

Disclaimer: this write-up describes the author’s own research and opinions, and does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I hold a material position in the issuer’s securities.

Just wanted to say keep up the keep up the good work. I appreciate your write ups they are always interesting.