Dear investors,

TIKR.com makes these ideas possible. It’s the best source of high quality financial data (CapitalIQ), provides customisable screens for 100,000 global stocks (the best feature, imop), analyst estimates, valuation metrics, transcripts, and ownership matrices. I’ve used the Bloomberg Terminal, and believe me, this is the most comparable platform at a much cheaper price: one month for $15 (a 25% discount). Check it out here.

The Spinoff.

International Paper (IP) spun off 80.1% of its stake in Sylvamo (which I’ll refer to by its ticker; SLVM) on October 1st, 2021. The distribution ratio was 11 IP shares to 1 SLVM share. As of 7th January, IP retained its 19.9% stake in the new firm, but plans to exit completely within 9 months.

Reasons for the distribution included:

increased management focus;

more efficient capital expenditures tailored to each business;

the creation of management incentives to align their interests with those of shareholders;

allowing management to execute growth plans with maximum flexibility, such as using improved equity currency for acquisitions;

optimisation of capital structures and leverage;

the ‘Special Payment’ to IP;

the retention of a 19.9% stake in Sylvamo, which will be disposed within 12 months;

enhancement of shareholder value.

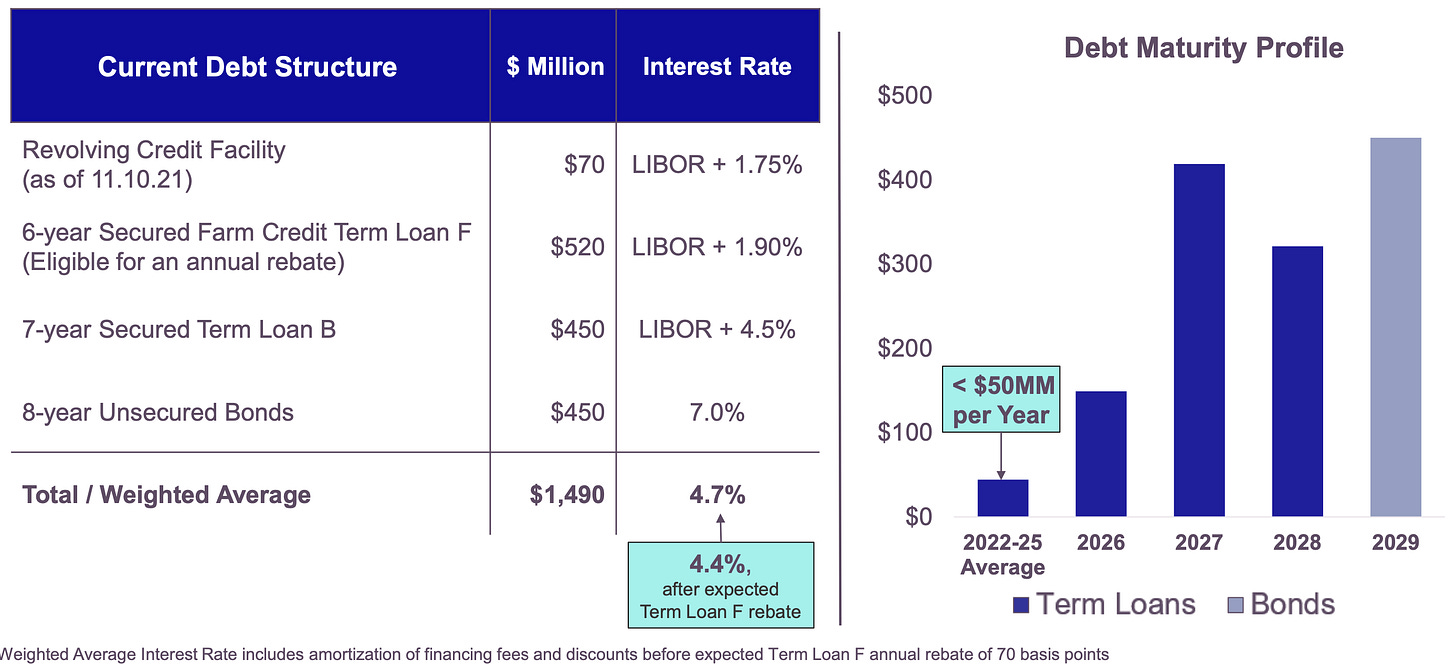

The ‘Special Payment’ refers to $1.6 billion in cash that will be transferred to IP post-distribution, and which will be financed through SLVM taking on debt.

Introduction

SLVM manufactures paper, specifically Uncoated Freesheet (UFS), which brings in the lion’s share of the firm’s revenue. It also produces market pulp and coated paperboard. These products are sold in the North American, Latin American, and European markets. The elephant in the room is that the market for UFS is in secular decline, with digitalisation seeming inevitable. However, I think that SLVM’s outlook is not as grim as it may seem, and even if it was, the firm would still be undervalued.

Low-Cost Operations & Market Position

SLVM owns seven mills, and six of these are vertically integrated. As stated by management, this has the effect of reducing input costs, such as pulp and energy, and reduces exposure to commodity price fluctuations. The seventh mill (Três Lagoas, Brazil) is not vertically integrated, but it does have a long-term contractual agreement with Suzano (a Latin American peer) that guarantees supply at favourable prices, essentially replicating vertical integration without the associated capital expenditures. This low-cost base means that 70%+ of SLVM’s mill capacity falls into the lowest quartile of global and regional cost curves.

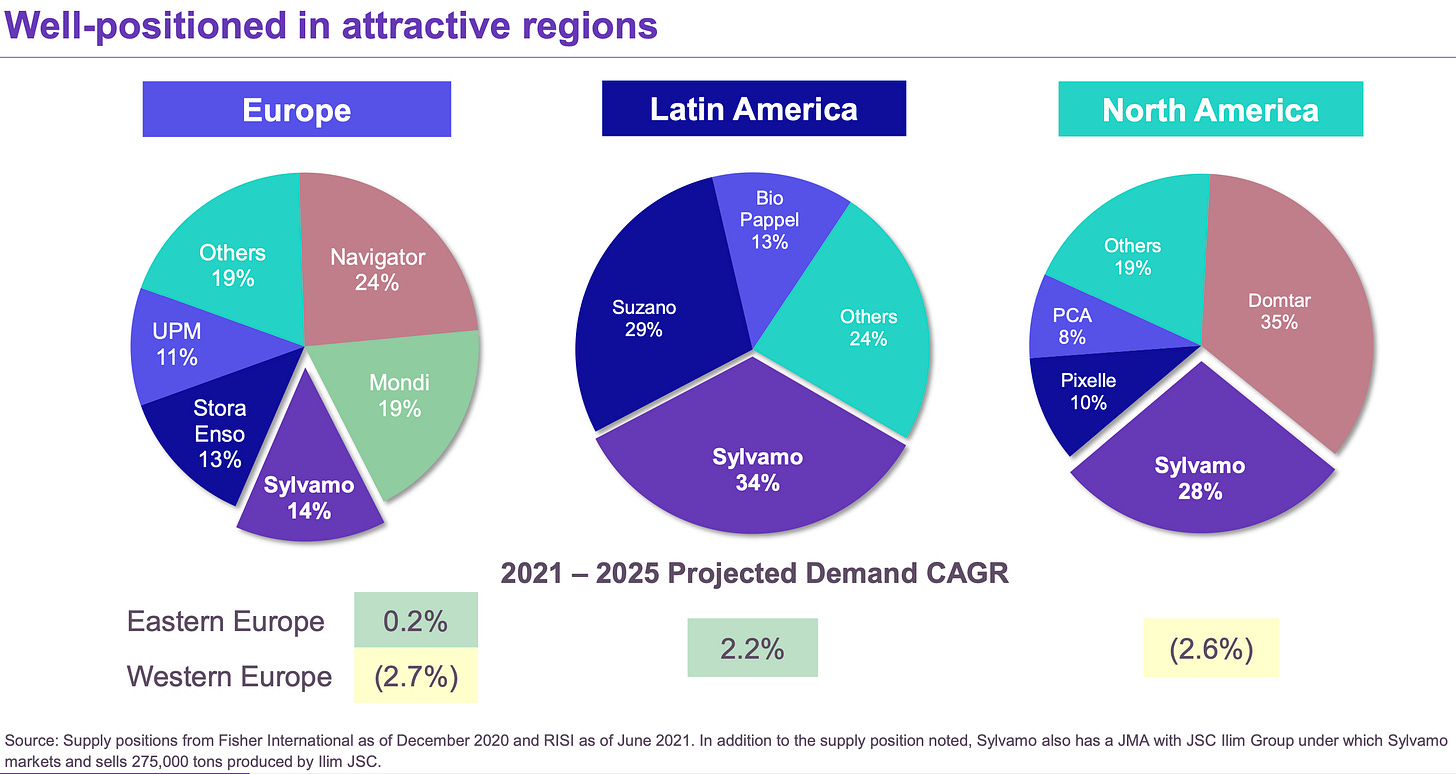

Further, the company has formidable supply positions across its markets. In Latin America and North America, the structures are duopolistic. In Europe, the firm occupies third place. Also, we should note that the outlook for the UFS market is more desirable in regions where economies are less developed, and it’s no coincidence that SLVM holds the leading share of supply in Latin America and Russia (latter not shown in graph, information taken from the prospectus).

This combination of cost efficiency and market positioning suggests that SLVM has economies of scale in place. In stable or growing markets, this is a barrier to entry, but in this case, it positions SLVM well to take UFS supply share and up its capacity as smaller competitors begin to earn returns below their cost of capital and exit the market. There is evidence that this is already happening in North America, where competitors have shut down about 24% of industry capacity since 2019, converting paper mills to container board and fluff pulp production.

Quality Brands and Customer Relationships

Top-tier, recognisable brands are imprinted on 60% of the firm’s cut-size paper; a product that makes up 60% of UFS sales. These include: Chamex (Brazil), REY (France), SvetoCopy (Russia), and Hammermill (USA), among others, plus a special licensing deal with HP Inc. that permits SLVM to use the HP Paper brand. The remaining 40% of cut-size paper is branded using private labels.

This portfolio of brands is not irrelevant; quality and reliability can drive loyalty, which supports sales. For instance, in 2020, SLVM’s own brand sales did not decrease to the same extent as overall industry sales, and in the past six years, SLVM has exceeded industry UFS shipments by approximately 1.2% annually. SLVM’s top ten customers, who collectively account for 33% of UFS sales, have also stuck with the company for more than 50 years. That’s another hurdle for smaller rivals.

Near-Term Upside

Back-to-work and back-to-school trends are currently driving demand for paper, but production is lagging behind. This has allowed SLVM to offset increasing input costs. Sales rose from $745 million in 3Q20 to $908 million in 3Q21, with operating earnings also up from $1.16 to $2.27 (same period). In line with this normalisation, I expect that full-year earnings (February 11th 2022) will be reflective of SLVM’s true earning power, and I’d expect an upwards movement in the share price.

Management Incentives and Planned Capital Returns

SLVM has 44.2 million shares outstanding, and 10% of this total is reserved for management under incentive plans, which is a substantial portion of equity. Insiders currently own about 0.83% of the firm. There’s also been some insider purchases since the firm was spun off. The CEO, two officers, and a director purchased around 70,340 shares in total, at a price between $30-32.

The CEO’s compensation for 2021 comprises $1 million in base salary, $1 million in cash bonus, and $3.3 million as part of the long-term incentive plan (LTIP). The CFO makes $575k in salary, $440k in bonus, and $1.05 million as part of the LTIP. It’s for these reasons that I think the interests of shareholders and management are well aligned.

The firm has also announced capital returns in the form of either buybacks, dividends, or a combination of both. These are likely to begin after debt is reduced to around 2.5x of adjusted EBITDA. I’d prefer buybacks, but dividends could also attract institutional capital, driving up the share price.

Financial Profile and Valuation

SLVM has net debt of $1.32 billion, and is therefore quite leveraged, but I’m not concerned about their ability to handle this. That’s because SLVM produces $423 million in stable, normalised free cash flow and has an evident focus on debt reduction. The rebound from COVID also reduces the threat.

Note that SLVM expects typical capex of about $130-150 million annually, but must sustain $220 million in boiler replacement costs for a certain mill. About 80% of this expense will be met in 2023-4.

SLVM currently trades at only 3.3x 2019 free cash flow, and 3.6x 2019 earnings. In contrast, public comps trade in a P/E range of 13-16 and P/FCF range of 11-13. I can only assume that the share price is depressed due to typical institutional selling of spinoffs; as holders of International Paper, why would they want a portion of a much smaller firm (SLVM has about 7% of IP’s market cap), which pays no dividend, and is leveraged?

It seems to me that the firm does not deserve this extremely pessimistic valuation, and I see SLVM as a potential double with a wide margin of safety.

Catalysts

Release of the full-year results.

A reduction in selling pressure.

New analyst coverage (only 1 currently).

The announcement of a dividend or share buybacks in 2023 (longer-term catalyst).

Disclaimer: this write-up describes the author’s own research and opinions, and does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I hold a material position in the issuer’s securities.

I couldn’t stop thinking about Dunder Mifflin when I wrote this. For another write-up on the VIC (not mine), click here.

One concern should be that 20% of shares overhang owned by International Paper. But once that is disposed of it will be a big net positive. So question is buy now, or in a year?

Interesting company, but the high debt levels are concerning. In the past I've considered investing in navigator (the European market leader) but ultimately i came to the conclusion that these commodity businesses have margins that are too thin to justify the capital expenses.

Still, I'll see if i keep an eye on this company in the future.