Nekkar (NKR)

Family-owned Norwegian micro-conglomerate with a prized asset and other early-stage sources of upside...

Investment Case

Prized asset with further upside from services, partly-owned firms, and ventures. Nekkar’s wholly-owned Syncrolift subsidiary is the market leader in shiplifts and ship-transfer systems, with its technology patented and a 60% market share, double that of the nearest competitor. Syncrolift has grown sales at a 15% CAGR in the FY16-23 period at EBIT margins of >20% and ROCEs of >40%, and it benefits from a real competitive advantage. Management has shown good execution in growing Syncrolift’s share of services revenue on a large installed base of 200 shiplifts, which will help shift it from blocks of revenue to recurring flows. Syncrolift is also paired with exposure to fast-growing (though competitive) industries like Aquaculture and Renewables through partly-owned, growing subsidiaries like Intellilift and high-potential ventures like Skywalker.

Successful buy-and-build strategy. Nekkar has demonstrated its ability to do value-accretive deals and reshape companies, as seen in its recent part-acquisition of ship IT solutions provider Globetech for 7.7x EBITDA (itself a recurring revenue; FY17-24E 18% CAGR; >20% EBITDA margin business) and its imminent, profitable turnaround of aquaculture player FiiZK (bought out of distress). It also bought Syncrolift for $3m in CY15, which was a phenomenal price. Sharing of knowledge between firms operating in related businesses also helps create synergies, as in the Techano Oceanlift and Skywalker overlap (motion-compensating cranes critical in both cases). Nekkar also holds zero financial debt.

Significant, long-term owners. The Skeie family has fielded Nekkar’s Chairman, Trym Skeie, and it owns about 35% of the firm all-in. Ramussengruppen, another family-owned entity, holds another 11%. These long-term shareholders allow Nekkar to execute its buy-and-build strategy with patience and vision. In fact, the firm itself has mentioned that shareholders should expect returns through capital gains, first and foremost.

Business Description, Markets, & Competitors

Nekkar is an Oslo-listed micro-cap and conglomerate which holds a portfolio of industrial firms active in shipyard solutions and fast-growing, ocean-based industries, all of which are at different stages of maturity. These subsidiaries were left behind after Nekkar sold its unprofitable cargo handling and offshore businesses to Cargotec/MacGregor in Feb 18 (products included cranes, gangways, winches, etc., and relevant services, provided to all sorts of vessel types).

Though this was the initial date of the agreement, the actual exit was sort of bungled: it took until Jul 19 to close and the buyer then sued Nekkar, arguing the portfolio was worth about half of the NOK554m it paid. These arbitration proceedings continued into FY20, when Nekkar finally settled the whole debacle for NOK94m. This fiasco also saw Eidesvik, CEO since Apr 16, replaced by temporary CEO Liltveld in Oct 20. The current CEO, Hansen, took over permanently in Jul 22.

Instead of looking at the operational segments (Shipyard Solutions, Renewables, Aquaculture, and Offshore), it makes more sense to break down the individual businesses.

We start with Nekkar’s cash cow and prized asset, wholly-owned Syncrolift (90% FY23 sales). Syncrolift is the global leader in designing and manufacturing shiplift and ship transfer systems, with a 60% market share based on the 33 contracts awarded in the CY12-23 period. This is double the share of the nearest competitor, Pearlson, forming what is effectively a duopoly. On average, 3 newbuild shiplift tenders are awarded annually.

Syncrolift has grown sales at a 16% CAGR in the FY13-23 period with an average EBIT margin of 22%. Estimated gross margins based on filings of the Syncrolift AS subsidiary are about 45% (very strong for a hardware provider) and typical ROCEs exceed 40%. In FY21 and 22, zero newbuild contracts were awarded in the industry due to customer postponements, which explains the downturn seen below.

The big question is whether this business is cyclical. Logically, this does seem to be the case, and having somehow managed to pull Syncrolift’s long-term headline performance, we see that there were marked downturns in FY99-00 and FY11-12. As of FY13, we see consistent YoY growth until FY23. This is a very long cycle and a possible peak, but given recent geopolitical tensions, there is reason to believe that naval demand remains strong.

Because of the contractual nature of its engineering business, Syncrolift’s revenue primarily consists of irregular milestone transfers as the outsourced construction is completed (75% FY23). There is also services revenue from the active, installed base of >200 shiplifts in the form of upgrades, maintenance, inspections, employee training, etc. (18% FY23). Management wishes to grow services revenue to NOK150m by FY24, and even though this source has lower EBITDA margins of around 20%, it is recurring and therefore very desirable. Other sources of revenue include R&D, sale of spare parts (technically also services), legal, etc. (7% FY23).

Shiplift solutions involve vessels being floated over a platform that is then raised out of the water vertically, whilst ship transfer products permit practical and safe horizontal movement. Combined, these solutions allow shipyards to handle as many vessels as they have room for in a safe and efficient manner, instead of being restricted by the availability of their dry-dock space. This allows operators to return to their core naval or commercial function as soon as possible (time is money and or security). Syncrolift also offers fast-docking solutions.

Importantly, Syncrolift is a patented technology invented by Raymond Pearlson in 1957, giving Nekkar exclusivity on this specific design type. Is this the same Pearlson whose name is borne by Syncrolift’s primary competitor? The awkward answer is yes. How did this come to be? Through a series of transactions. In 1979, Pearlson Engineering Company (PECO) was sold to Northern Engineering Industries, then to Rolls-Royce in 1989, and finally to Nekkar (then named TTS Group) in 2015 for a mere $3m.

Needless to say, this was a fantastic deal for Nekkar: Syncrolift did $12m in EBITDA in FY23 alone. Meanwhile, Pearlson Shiplift Corporation was founded by Douglas Pearlson, Raymond’s son, in 2008, after Rolls-Royce closed its Miami shiplift headquarters; most of its employees were former PECO engineers. Today, Pearlson is led by Kelly Fraind, Raymond’s granddaughter. It still claims credit for the invention and installed base of Syncrolift systems (family legacy, etc.). There is generally quite a lot of misinformation and flexing from Pearlson in the media, and its claims are actively disputed by Nekkar (see comments in that link).

Syncrolift serves newbuild and repair shipyards operating in the Commercial, Naval, Mega Yacht, and Offshore spaces. It should be noted that shipyards are often multi-purpose, for example, Commercial and Naval customers are often accepted by the same shipyard. Average lead times in this bespoke and complex engineer-to-order business are very long, at 18-24 months for newbuild shipyards and 12-24 months for upgrades.

Commercial shipyards account for most of the installed base and depend on economic cycles. But Syncrolift’s most important customers are Naval, where investment is often countercyclical, primarily because they have high-value vessels and emphasise safety. With its expertise in safer, more complex rigid platforms that can handle redundancies like a wire snapping, Syncrolift is often their first choice, and the firm holds a dominant share of these systems at 75%, significantly higher than its general share in shiplifts of 60%. This is also the reason that Mega Yachts and Offshore structures have minimal relevance for Syncrolift. Nekkar claims that, in past decades, Syncrolift has delivered 19/20 of the highest-capacity (rigid?) shiplifts worldwide.

Privately-held Pearlson supplies cheaper, articulated platforms, which Syncrolift stopped providing in 2015. This is certainly part of the reason that Pearlson has a strong presence in the Mega Yacht segment (not a focus for Syncrolift). Importantly, Syncrolift offers a technology called Calypso that increases the safety of articulated platforms, either through upgrades or conversion to rigid systems. This initiative could help restart the 100 or so older Syncrolift shiplifts that are out of use primarily due to poor maintenance and safety concerns and might also draw services market share from Pearlson and others.

Another market observation is that naval customers, due to the sensitivity of military operations, might be reluctant to hire foreign companies to do work for them. In India, for example, foreign firms need to work with locals or see forced discounts in the tender process of up to 20%. Of course, this conflicts with the duopoly of this industry, as evidenced by Chief Minister Lawlson’s comments on the $48m Darwin (Australia) shiplift tender awarded to Pearlson in CY24: “there wasn't a company that was able to provide [the necessary] components for the shiplift, so we had to go to an international provider.” Naval customers, in particular, also prefer to do at least some of the services work themselves to reduce dependence on externals.

Other market observations are that Pearlson has seen some protectionism in the US and China has been sealed off, as the world’s largest shipbuilder by gross tonnage continues to work in old-school dry-docks (high potential though, with 2/3 of ships built by government shipyards).

Syncrolift’s pipeline stands at NOK4bn, and we can assume the Naval market accounts for a good share of it due to current geopolitical tensions. If we assume a 60% historic win-rate (the CEO stated in 1Q24 that Syncrolift will maintain its market share based on the outlook), Syncrolift could see NOK2.4bn in new business in the next 3 plus years. Combined with the secured backlog of NOK617m, there is strong revenue visibility.

Nekkar’s Syncrolift certainly benefits from barriers-to-entry through its patented technology if renewed, and the extremely high cost of failure e.g., a $1bn destroyer slips off its lift or transfer system and kills a few workers. This explains the duopolistic structure of the market, which I do not expect to change. Bardex, the third player, holds a minuscule share of something like 5%. It is also reasonable to assume that, unless a contractor has several overlapping orders, there might be serious cash flow problems (several firms in the space have gone bankrupt).

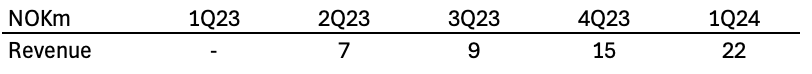

Intellilift (51% stake; 6% FY23 sales), acquired for NOK15m in FY19, delivers industrial software to digitise workflows through automation and remote control of systems for drilling and offshore load handling. It primarily serves offshore clients and saw a breakthrough in FY23 as it won its first software automation contract with the Transocean Norge drilling rig through its IntelliWell JV (formed with Transocean and Viasat, a global communications company). The point of Intellilift’s offering is that it smoothens workflows and increases consistency and efficiency on drilling rigs, which reduces operators’ emissions and costs.

Intellilift’s sources of revenues are three-fold: one-off contracts, perpetual upfront software licenses, and classic SaaS. Importantly, Intellilift sources revenue both externally and internally through provision of its services to other firms in the Nekkar group like Techano Oceanlift. The margin profile of this scalable, recurring revenue business is attractive, though growth has been inconsistent based on what is a short period of operation.

Techano Oceanlift (90% stake; 4% FY23 sales) is a provider of smart load handling systems like cranes and gangways for the renewable energy, aquaculture, and offshore energy industries. It was acquired in March 23 for an immaterial amount, in-line with Nekkar’s buy-and-hold strategy. The value proposition of Techano’s motion-compensating, smart solutions is that they reduce downtime, optimise productivity, and enhance general operational performance.

In FY23, Techano won two crane contracts worth a total of NOK100m for an underwater construction vessel and an inspection, maintenance, and repair vessel (both active in offshore). These contracts helped generate sales of NOK31m in FY23, with EBITDA of 1m. Pricing is expected to improve significantly with more volume and greater customer trust through a longer presence in the market. New models of offshore and subsea cranes were developed in FY23 to handle increased demand; these can be electrified, including the winch, which delivers regenerated power back to the carrier vessel.

According to the FY23 outlook, further growth for Techano is likely ahead…

“It is predicted that a significant number of new offshore energy systems will be installed in the coming years, within both oil and gas and renewable energy. A potential increase in newbuild offshore vessels could represent opportunities for Techano Oceanlift.”

In FY23, Nekkar purchased a 39% stake in FiiZK (BEWI Invest owns another 40%), a supplier of technical textiles, software solutions, and fish cages to the aquaculture industry, for NOK50m. This consideration was split into NOK25m in cash and the contribution of Nekkar’s unique, closed fish cage technology, Starfish, valued at NOK25m. Nekkar still has the right to acquire all other shares in FiiZK until June 26, and it reports the stake as financial income or expenses (not consolidated).

Nekkar’s stake in FiiZK is certainly an attempt to increase the chances of successfully commercialising its closed-cage Starfish technology through leveraging combined expertise at a bargain price. Despite FiiZK’s strong growth in the FY16-22 period (FY22 sales of NOK300m), the Norwegian government’s latest 25% tax on salmon farmers killed demand for its solutions, causing it to enter financial distress. A strategic review is ongoing, and Nekkar’s CEO aims to complete it as soon as FY24, ideally with a profit.

FiiZK’s product range includes land-based, sea-based, and digital solutions. I will focus on the most important sea-based solutions, because sea-based systems seem to be its area of expertise and FiiZK Digital (10 clients; 40% of Norwegian farmed salmon is somehow connected to the Horizon platform; around NOK25m in ARR) was sold for an undisclosed amount in Jun 24.

FiiZK’s closed cage system, named Protectus, combines the best features of the previous models (including Starfish), has been installed in >20 locations worldwide, and has collectively processed >70 fish cycles. Its benefits include no escapes, waste collection, zero lice treatment, a stable temperature, and full automation. In lice skirts, which are replaced every 1- to 3-years depending on conditions, FiiZK Protection holds a Norwegian market share of 80%, though its profitability is unclear.

But the most crucial aspect of all is the exposure to the attractive Norwegian aquaculture market, which is sized at >NOK100bn and has grown at mid-single-digits in past decades. Salmon accounts for the lion’s share of output (80%), with rainbow trout in second place (15%). The market is thoroughly regulated by the government: 120 companies hold about 1200 licenses and there are up to 5,000 pens for salmon and trout around the country.

Farmers have been heavily criticised for poor fish health (primarily due to sea lice and rough delousing treatments) and escapes, the latter causing breeding with wild salmon that produces weak offspring. These problems are exactly those that FiiZK’s Protectus claims to solve, and the Norwegian government wants to sustainably increase production from 1.5m to 5m tons per annum by 2050 (5% CAGR). The opportunity for FiiZK and Nekkar, then, is the provision of best-in-class closed systems to customers who wish to grow their output sustainably. Nekkar’s long-term orientation and financial support definitely increases the chance of success.

A brief overview of the pre-revenue, wholly-owned venture business that is Skywalker. Established in FY22, Skywalker is an offshore wind turbine installation and service tool which hoists itself up turbines and can be controlled from a distance, making it a better option than using several specialised vessels to move components back-and-forth from land. In fact, for services, an operation like replacing a large component (gearbox, blades, etc.) can result in up to a month of downtime. Its motion-compensating technology also allows it to be used in harsher conditions. This is the core value proposition and target market, though Skywalker can also be used for onshore turbines.

Viability of the Skywalker system is supported through research grants, like the recent award of NOK75m to a Nekkar-led consortium through the Norwegian Green Platform Initiative. Naturally, the offshore wind turbine installation and services market is growing quickly, as the world moves to net zero by 2050.

Now that proof-of-concept is complete, Nekkar is actively looking for partners to commercialise it, with first revenues expected in FY26, starting with bottom fixed as opposed to floating turbines.

Nekkar acquired 67% of Globetech, a one-stop-shop for maritime ICT solutions (hardware and software), in Jul 24. The EV was NOK120m on a 100% basis, so the purchase price was about NOK79m, paid NOK64m in cash and NOK15m in shares. Nekkar has also committed to buying the remainder in CY27, based on a multiple of EBITDA achieved in that year.

A few more facts on Globetech, from Nekkar’s press release:

>10-years of profitable growth;

management incentives and lock-in coming in the next 3-years;

150 vessels in long-term, recurring revenue contracts.

For an 18% FY17-24E sales CAGR and about 20% EBITDA margin and a recurring revenue base that helps Nekkar wean itself away from one-off Syncrolift contracts, a multiple of 7.7x EBITDA pre-synergies looks like a very good deal.

Strategy

As mentioned, Nekkar is best viewed as a buy-and-build acquirer, fuelled financially by Syncrolift.

Officially, it aims to leverage its decades of expertise in offshore engineering, automation, electrification, and digitisation, to acquire, develop, and commercialise disruptive technologies that make high-growth, ocean-based industries more profitable and sustainable. It looks to maximise value and create synergies between its wholly- and partly-owned companies, considering itself a flexible owner, as demonstrated by its willingness to build JVs like Intelliwell, purchase non-controlling stakes as in FiiZK and Globetech, and find partners for commercialisations.

At the lower-level, its strategy for Syncrolift is most relevant to our case. Here, management wants to increase the share of recurring services revenue by taking advantage of the 200 or so shiplifts installed globally, with a NOK150m target for FY24. Nekkar has also stated that it plans to generally expand its SaaS offerings in the future, which would likely make its financial profile even more attractive (higher-margin, scalability).

Management & Ownership

Nekkar’s CEO is Ole Falk Hansen. He took on the role in Jun 22 after 5-years of leading Beckman, a Norwegian backpack producer. This experience seems irrelevant, but further back, Hansen was CFO at HMH, an international drilling firm, and Head of M&A and Strategy for Aker Solutions’ drilling division. He holds 0.4% of shares and was paid NOK3.8m in FY23 (primarily salary and bonus; translates to a reasonable €320k). There is no information on how the bonus is determined, but it is limited to 50% of base.

As to ownership, the Skeie family holds >35% of Nekkar both through individuals and three entities: Skeie Technology, Skeie Consultants, and Skeie Kappa Invest. Trym Skeie is Chairman of Nekkar’s board, and has a great deal of experience in growth-stage and venture companies. About 11% of shares are held by Rasmussengruppen, which seems to be a family-owned, Norwegian conglomerate with investments in the financial, real estate, and offshore space. With these cornerstone holders, it seems likely that Nekkar will have the long-term (and not the quarter) to develop its portfolio.

Ideally, I would want to see the CEO incentivised with share options, even if that results in some dilution.

Risks

Inability to fund operations with own cash flows. Syncrolift would of course be a very attractive business on its own; the reason it is still attractive when included in this micro-conglomerate is that it accounts for the lion’s share of revenues and profits. However, these cash flows are used to fund higher risk investments, like that made in FiiZK. If the latter cannot stand on its own two legs financially, there is the risk of a cash drain, in particular if we consider that big, irregular contracts can cause some inconsistent OCF. For example, in FY22, there was a NOK93.5m cash outflow due to accrued, non-invoiced production. Nekkar now holds about NOK133m in cash, plus more funds in credit facilities, which mitigates this risk. Management has also set the target of achieving FiiZK profitability in the current FY.

Illiquidity. According to Koyfin, Nekkar’s average 10-day volume is about 65,585 shares, which translates into roughly €87,800 worth of trades per day. This amplifies the effect of big purchases and sales. It could be hard to exit the stock if there are negative developments which change the thesis.

Lack of tender wins for Syncrolift. As the core driver of the business, Syncrolift must maintain its market share going forward; this is definitely the elephant in the room. The past handful of contracts being awarded to Pearlson make for a pessimistic image, even if management has explicitly stated that its share will be maintained based on orders received and the NOK4bn tender pipeline. Acceleration of Naval demand is definitely welcome and could serve to mitigate this risk partly, as Syncrolift’s rigid systems are theoretically in particular demand here.

Syncrolift’s customer concentration. In FY23, Syncrolift’s top three customers accounted for 23%, 19%, and 18% of its revenues, respectively, so there is a risk in concentration, which overrules the safety of overlapping contracts and an increasing share of stickier services revenue.

Freak accidents. Syncrolift no longer provides riskier articulated platforms as Pearlson does. But this does not exclude the chance of something going very wrong during a a lift or transfer, with all of the ensuing reputational damage and loss of market share.

Valuation

Not knowing the cash conversion of Syncrolift but expecting big swings in working capital, it seems best to value Nekkar with a SOTP. I value Syncrolift at 12x EBITDA, Intellilift and Techano Oceanlift at 4x, FiiZK at cost (though profitability is expected in FY24), and Globetech at 10x. I then add net cash of NOK130m, modified for the Globetech acquisition, for a target price of NOK18, for a conservatively estimated upside of around 60% on a current price of NOK11.25. Skywalker is entirely excluded, as is the potential upside from a successful FiiZK/Starfish turnaround; both represent genuine opportunities.

Conclusion

Nekkar, with its illiquidity, micro-cap status, and garbled financials at the group level, seems to be an overlooked conglomerate with significant potential. It owns a very desirable asset in Syncrolift and has demonstrated an ability to buy-and-build its smaller holdings successfully. The biggest risk is that Syncrolift fails to win significant tenders, though this is partly mitigated through its backlog, pipeline, more Naval demand, and track record. It is also worth emphasising that we assign almost no value to FiiZK (profitable turnaround expected in FY24) or Skywalker, so these are essentially free upside options.

Disclaimer: this write-up describes the author’s own research and opinions. It does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I hold a material position in the issuer’s securities.

Hello Johan and thank you so much for your deep analysis.

Could you give me more colors about how do you choosed the Ebitda multiples to use in the SOTP valuation please?

Cheers ;)

Giorgio

Nice article. Will do some more research on this company.

Do you agree that you pay a fair price for Syncrolift & get everything elso for free?