Moonpig Group PLC (MOON)

The sold-off UK and Dutch market leader in online greeting cards seems like a cheap scoop.

Thesis brief.

Moonpig Group PLC spearheads online card retail in the UK and Dutch markets. It gathers far more data than rivals, has an excellent platform, and several competitive advantages. Since its oversubscribed IPO in November 2021, the stock has lost about 60% as the IPO speculation faded and it became clear that its abnormal pandemic results would not be repeated again in 2022 or even 2023. However, the growth case still shines bright, and at an EV/EBIT of 10.9x, high margins, mid double-digit revenue growth, and stellar returns on capital, investors should take the shot.

The business.

Founded in 2000, Moonpig Group PLC is the leading online retailer of greeting cards in the UK and the Netherlands. The firm went public to strong demand in February 2021 with a small primary offer of 6m shares that raised £11m in net proceeds and a much larger secondary offer of 135m shares which permitted several PE exits. 3/4 of the Group’s revenue stems from the UK Moonpig brand and the remaining 1/4 comes the Dutch Greetz brand, which was acquired in August 2018.

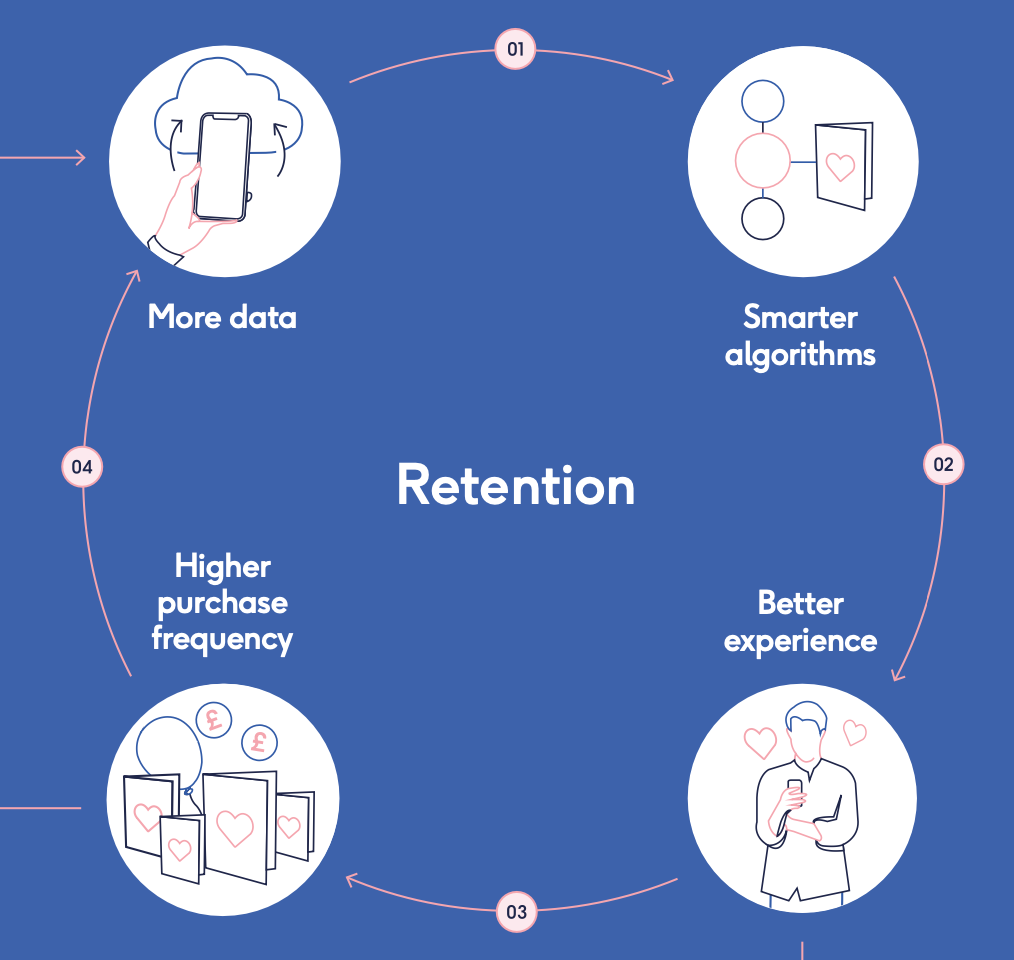

The Group’s model is capital-light and simple. Moonpig and Greetz operate websites and well-reviewed mobile apps which allow customers to purchase cards and gifts for recipients. Throughout the transaction process, the Group’s platform gathers various datapoints on users, such as age, occasion, and relationship. This data feeds algorithms optimized across >230m transactions which, in turn, generate highly personalised experiences and contextual recommendations for each customer.

Because pages are tailored to each user and the calendar events that spur 90% of purchases are recurring, an impressive 86.5% of sales in 2022 came from existing customers. Pleased card recipients also often become customers; this lowers their acquisition cost as long as the transaction platforms are consistently improved and significantly better than those of rivals. Cards are manufactured on-demand – hence the low inventories – in both the Group’s own production sites and those of third parties, with leading next-day delivery cut-off times of 9PM in the UK and 10PM in the Netherlands.

It is critical to understand the cards market and the Group’s strong position within its online segment. The overall (online and offline) cards market in the UK is sized at £1.6bn and has shown resilience throughout economic scenarios, with YoY growth consistently in the range of 0.1% to 2.6%, even during the great financial crisis. This is an important consideration for some shorter-term investors in the current environment. Moonpig holds a 68% share in the UK online segment, which is 4.4x that of the nearest competitor (Funky Pigeon, owned by WH Smith). Online penetration is expected to double from 16% in 2022 to 20% in 2025. In the Netherlands, the cards market has a smaller size of £0.3bn, but Greetz holds a similarly large 67% share of the online segment, which equals 3.2x that of the closest competitor (Kaartje2Go). Dutch online penetration is projected to increase from 20% to 23% in the 2022-2025 period.

Resting on these impressive laurels makes little sense due to the small size of the UK and Dutch card markets and the fact that, in the UK, 72% of cards are given with a gift. Hence management has decided to expand into the much larger, underpenetrated (12% online) £24bn card-attached gifts market of the UK and the Netherlands, where the Group can leverage its rich data pools and personalisation technology to cross-sell (and upsell) to customers with minimal additional marketing costs relative to pure gift retail rivals. Progress in this strategy can be seen in the increase in the percentage of total sales derived from gifts, up from 41.7% in 2020 to 47.7% in 2022.

The latest step in the above strategy was the £124m acquisition in May 2022 of BuyAGift, which operates the leading BuyAGift and RedLetterDays experiential gifting platforms in the UK (e-retail, retail, and B2B sales channels). Part of the rationale for this purchase was the secular, long-term shift in gift preferences from physical items to experiences, primarily driven by younger generations. The multiples paid were 2.8x sales and 8.8x adjusted EBITDA, but whether this acquisition will create value depends on whether the combined companies can produce more cash flows than before due to accelerated revenue growth and or cost reductions (synergies).

I believe the acquisition stands a good chance of creating value for two reasons. First, management plans to leverage the Group’s proprietary technology, data, and marketing capabilities to accelerate BuyAGift’s sales growth from historic low double-digits (2011-2022) to mid double-digits, and second, as we know, merging card and pure gift platforms together permits cross-selling with negligible incremental marketing costs, which could boost BuyAGift’s operating margins and thus cash flows. Management has predicted that the ROIC of BuyAGift could exceed its WACC as early as Year 3 of the acquisition.

Thesis points.

The Group’s innovative model has several competitive advantages. First, its leading market shares in the online cards space allow it to accumulate between 3x to 4x the data of the nearest competitors. Since more data drives more accurate algorithmic personalisation and platform optimisation, the user’s experience will improve whilst the market share advantage widens over time (though not until the end of time - there could be a sweet spot where more data results in lesser returns).

Second, the model is highly scalable. New customers can be both added – the Group’s net promoter score falls into the top quartile of tech companies at 71% – and upsold at zero additional cost due to the card-first customer acquisition approach, which is not the case for offline card and pure-play gift competitors.

Third, the Group benefits from a fair degree of customer lock-in. A customer whose account has been personalized over time and who always receives tailored card and gift recommendations, and reminders of family and friends’ birthdays, is unlikely to switch over to a new online specialist’s ecosystem, where the algorithms must start from scratch (not to mention the additional disadvantages of offline providers). New products can also be added at small additional cost, but produce a big value add for users on a quest for the perfect gift. The above advantages make it more and more difficult over time for smaller players to compete with the Group as their returns decrease or fall below their cost of capital.

I would argue that the Group’s model has clear benefits over the traditional offline, and even omnichannel, model of card retail. This is best illustrated by an concise analysis of Card Factory PLC (CF), which is the sole meaningful public rival of the Group (hence no relative valuation). At first glance, CF seems impressive: the company produces and sells between 1/3 (pre-pandemic) to 1/4 (post-pandemic) of all cards in the UK and is ranked as #1 across value for money, the breadth of its product range, and diversity of price points. CF’s economies of scale are bolstered with a huge retail network of over 1,050 owned stores and 554 partner locations in the UK and Ireland, with a further 364 partner locations in Australia. This exposure has helped create a strong brand.

However, besides the ‘hard’ advantage of scale economies, CF appears to be falling behind. As mentioned, online penetration of the otherwise stagnant card market is expected to grow consistently, but CF’s online share of sales in 2022 was a mere 10%, reflecting a negligible online card market share of 2.7% (up from 2.3% in 2020). The acceleration of digitalisation during the pandemic will also have rubbed salt in the wound. Its net promoter score stands at 44 i.e., a mere 44% of customers would refer CF to a friend, compared to 71% for the Group. This implies that the Moonpig and Greetz’s value proposition is superior.

As part of its Opening our New Future strategy of becoming the leading omnichannel card retailer (with the main target of £600m in sales by 2026), CF also plans to enter the card-attached gifting market. But this will be more difficult and expensive relative to the Group’s. That is because of CF’s lesser ability to cross-sell effectively and at minimal additional cost - the Group has much more data, technological know-how, and better algorithmic personalisation. Moving into gifts could also negate CF’s valuable scale advantage as manufacturers would have to shift to gift manufacturing.

This leads me to conclude that CF’s position somewhat resembles that of Sylvamo in the shrinking paper manufacturing industry: a cash cow and volume leader that can outperform in a shrinking market and price out weaker competitors over time but still lacks true growth potential. For what it’s worth, CF also has significantly worse employee relations than the Group, according to GlassDoor (4 stars for Greetz and 4.8 for Moonpig relative to 3.2 for CF).

Here is a short financial comparison between CF and the Group (notes below). View the much higher ROA, margins, and sales CAGR of Moonpig Group.

CF sales and margins were significantly affected by store closures during COVID.

ROA used as the Group has negative equity and ROA reflects intangibles like the technology platform and goodwill from acquisitions.

Net Debt used as the Group has negative equity, making ratios like D/E useless and incomparable. But the companies have similar revenues in 2022.

Last but not least, the Group’s successful execution on its strategic priorities is encouraging, with obvious progress on all KPIs in the past three years (notes below).

Existing customer share is up from 80% run-rate due to pandemic boost.

Mean order value has risen due to the increase in gift mix but is expected to remain stable in the short-term.

Card-attached gifting drives absolute gross profit at zero incremental marketing cost and does not dilute operating margins. 85-90% of gifting is card-attached.

Valuation.

I used a DCF due to the Moonpig Group’s obvious growth potential. The assumptions are given below:

Mid double-digit revenue growth in the mid-term as per management guidance.

Stable operating margins of 20%.

Decrease in the tax rate to 18% in 2023 as BuyAGift will increase the proportion of profits earned in the lower-taxed UK. Increase in the tax rate to 22% in 2024 and onwards due to an official UK statutory tax rate increase from 19% to 25% that becomes effective April 1st, 2023.

2023 capex of £26m as per guidance, with £12m of that tangible due to expansion of the Tamworth (UK) and Almere (NL) facilities and £14m of run-rate intangible software improvement. Intangible capex is expected to remain around this level or increase in the mid-term, whereas normal tangible capex should be around £2m. Hence, I modelled continuous capex of £18m in the mid-term (£2m tangible plus £16m intangible).

Based on the above model, I believe Moonpig Group PLC could double to reach intrinsic value. The recent depreciation of the share price could be due to speculation after the short-term pandemic boost to the Group’s revenues and profits i.e., the assumption that the shift to online would be more instant instead of an accelerated transition: 2021 provided a tough comparator and disappointing outcomes when normalised 2022 results were released. In addition, investors might doubt the strategic rationale of the BuyAGift acquisition. There is also significant negative sentiment towards the UK market as a whole.

Risks.

Protection of data and avoidance of downtime is up to the IT team. The Group’s supply chains are short and cost inflation, which relates primarily to shipping costs and wage increases for the staff of third parties, has been limited. Rising energy costs have also had a minimal impact on the Group.

The main risk I see is that the expansion into card-attached gifting is less successful than anticipated. This would prevent the Group from leveraging its data-driven card-first customer acquisition to cross-sell and leave it stranded in the smaller single cards market, where online penetration is increasing consistently but nonetheless at quite a slow rate.

£69m of net long-term debt must be paid back within the next three to four years. I see no cause for concern here because I expect almost twice this sum (£130m) to be produced as free cash flow in the 2023-2025 period. In addition, an undrawn RCF of £20m remains available.

Other information.

I admit the compensation structure for 2023 is not ideal, in particular for the long-term incentive plan (LTIP). This is because the LTIP’s components focus on a three-year relative TSR and EPS, which could encourage short-termism.

Annual bonus: revenue (30%), adjusted EBITDA (50%), customer NPS (10%), employee engagement score (5%) and sustainable sourcing of paper and card (5%). 33% of the 2022 bonus was transferred as shares, to vest in three years, which I anticipate will happen again in 2023.

LTIP: TSR relative to FTSE 250 for three-month average to April 30, 2025 (50%), and adjusted basic pre-tax EPS for the FY ending April 2025 (50%).

Insider ownership.

Nickyl Raithatha (CEO) owns 2.8m shares outright, and could own up to 5.6m depending on the vesting of options and continuous employment. This would correspond to 1.6% of total shares.

Andy McKinnon (CFO) owns .1m shares outright, and could own up to 1.2m depending on the vesting of options and continuous employment.

Kathryn Swann, non-exec and Chair, owns 2.5m shares outright.

Note that it’s not only about the proportional ownership, but also the actual market value of owned shares. For example, TIKR.com estimates the value of the CEO’s shares at $5.8m.

Disclaimer: this write-up describes the author’s own research and opinions, and does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I hold a material position in the issuer’s securities.

Nice article. I'd imagine the thing that is scaring the market. Here is the huge drop in YoY revenue. But this seems like a compelling GARP pick if we think that we are experiencing some COVID pull forward and growth is going to resume.

As someone not from the UK, I'm interested in if you have any context on the culture around card giving in the UK? As a US resident I'm surprised to hear that the overall card market is expected to grow.

Some obvious yet overlooked observations made on how retention in the greeting gifts business is underpinned by the natural driver of reoccurring dates—and of course… Data! Arguably already a household name, still, Moonpig may style growth stock pickers. But first, they’ll have to be sure the online push doesn’t underwhelm!