Elon Musk’s Twitter Affair

Love him or hate him: Elon Musk has a penchant for drama.

Last week, the Tesla and SpaceX CEO unveiled a 9.5% stake in Twitter, which I will describe as the social media platform that serves as a playground for elderly celebrities. Twitter’s boss, Parag Agrawal, must have been shocked, but his reaction was nonetheless accommodative, and he offered Musk a seat on the firm’s board.

“He’s both a passionate believer and intense critic of the service which is exactly what we need on @Twitter, and in the boardroom, to make us stronger in the long-term.”

But Musk later stated that he wouldn’t join the board after all, and the ‘passive investor’ filing that he had made with the SEC - ten days later than required, of course - also belied his true intentions. In fact, Musk offered this week to privatise Twitter at a price of $54.20 per share or circa $43 billion.

It was always inevitable that this oddly specific price would be interpreted as a marijuana reference - remember the Joe Rogan incident - and this would fit in to Musk’s trend of being a people-pleaser. But for all his efforts, I was surprised to find that the world’s richest person occupied only 8th place in the most-followed-people-on-Twitter ranking as of April 1st, 2022. At 81 million fans, Musk is far behind Obama, who has 131 million followers.

Anyhow, see Musk’s letter to the Chairman of Twitter below.

Bret Taylor

Chairman of the Board,

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

Free speech. What a noble cause! Musk has turned into an activist. But can we accuse Twitter of suppressing expression? Yes, Donald Trump was banned from the platform in 2021 for his inflammatory tweets. But those were correlated with a raid on the U.S. Capitol, which was a tense and dangerous moment for American democracy.

Twitter is now on the defensive, and the firm has adopted a so-called ‘poison pill’ that would prevent Musk from increasing his stake. To be specific, this legal manoeuvre means that if Musk were to increase his stake to 15%, all other shareholders would have the option to purchase more shares at half-price. The dilutive effect of this would make the acquisition of more shares much more expensive. However, the market doesn’t seem to think that Musk’s offer will materialise; Twitter now trades at $45, which is far removed from the $54.20 discussed earlier.

There’s also been talk about the lack of insider ownership at Twitter. The firm’s co-founder, Jack Dorsey, owns around 2.4% but has left the firm, and the interests of the current board are negligible. From an investor’s perspective, the lack of alignment between shareholders and insiders’ interest is a major turn-off.

However this saga ends, Musk will again have exhibited his ability to move the entire market with his on-the-spot actions. Tesla’s shareholders will be used to this, but only some will acknowledge that Musk’s exuberance is both an asset and a liability.

U.S. Inflation Data and the ECB’s Dilemma

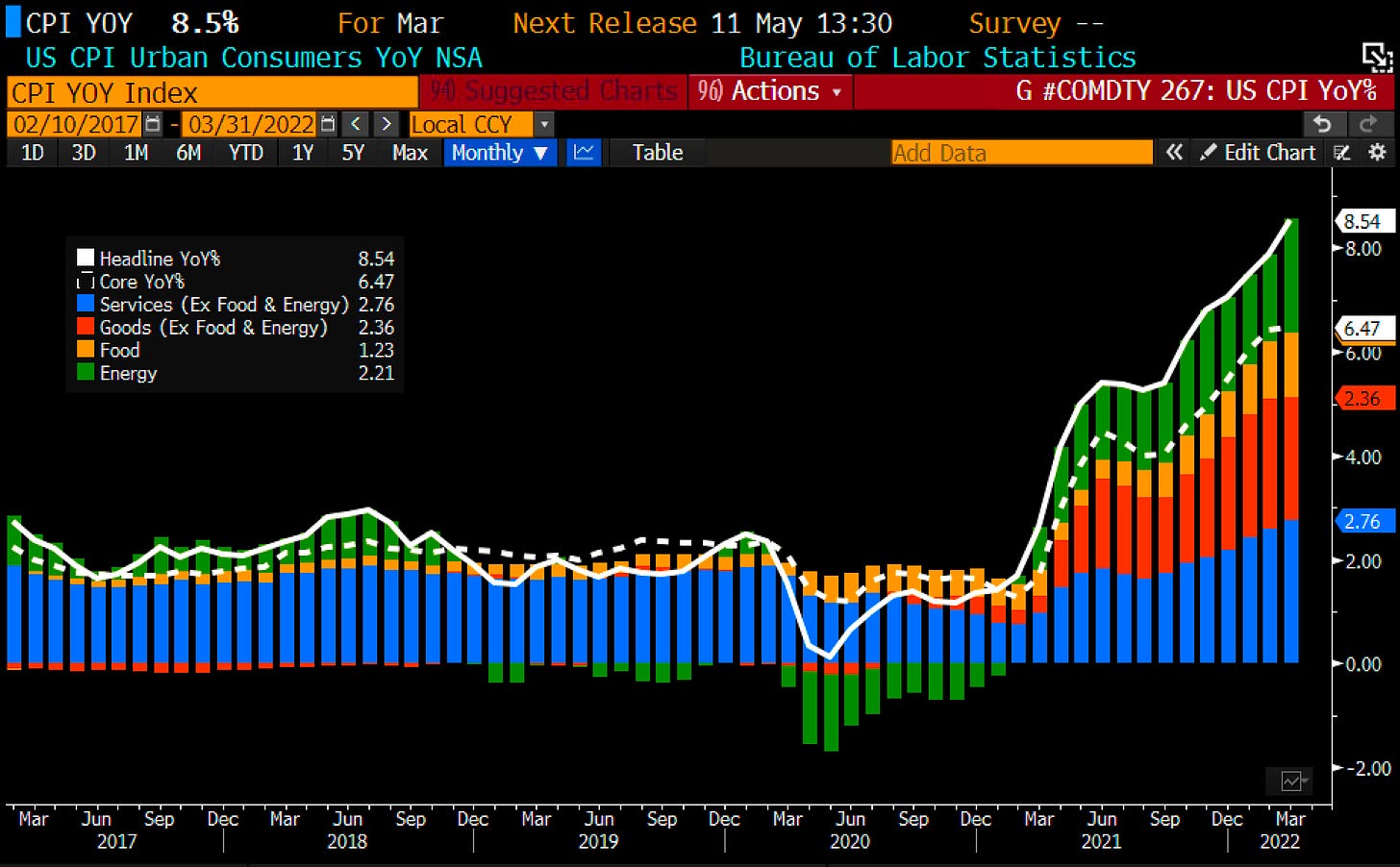

The U.S. CPI data for March has been released, and it doesn't look healthy. Headline YoY inflation stood at 8.5% whilst the core CPI, which excludes food and energy, came in at 6.5%. See the chart below for a more detailed breakdown.

This market environment is obviously unusual as participants must consider a unique blend of record inflation; a Chinese lockdown so serious that robot-dogs are broadcasting information; negative real yields on bonds; imminent, 50 basis-point rate hikes combined with a planned shrinkage of the Fed’s balance sheet; possible European stagflation; a weird status quo in cryptocurrencies; and a war in Ukraine.

What’s not to like? But seriously… if there’s anything we can be sure of in these times, it’s that this will be a valuable learning experience for policy makers, traders, investors, and everybody else. The question is how painful it will be, and for whom.

In particular, the financial situation in Europe calls for further discussion. Headline inflation in the Eurozone hit 7.5% YoY in March. This is problematic enough in itself, and when combined with negligible economic growth due to compromised energy supplies, the continent could see toxic stagflation. I know, it’s an apocalyptic forecast. But the situation is precarious. The amount of power and trust vested in central banks is insane, and we should be skeptical of their ability to wield it.

Some prominent figures, such as Otmar Issing, who was one of the masterminds behind the Euro, have pummelled ECB officials for their inaction.

“The ECB relied on its forecasting model and this model cannot give the right signals because it is based on the past and cyclical experience, and the pandemic did not cause a cyclical downturn. If you have a misdiagnosis, of course, you have a misguided policy.”

“It is obvious the ECB is late to react, while the Fed might be even more behind the curve.”

Too little, too late? The ECB is far behind other central banks in terms of fighting inflation; no rate hikes have been introduced and the organisation is still purchasing bonds. Meanwhile, the FX market has sent the Euro down.

I must state that I have a problem with projections of doom; it’s always been possible to create an argument for the impending demise of something, and these works always attract eyeballs. A common one now is that the Dollar will lose its reserve status because, with the blocking of Russian FX reserves, the planet has realised that unbacked fiat currencies are worthless. There are lots of problems with fiat money, and it’s an interesting thesis, sure, but likely?

It’s still important to check the pulse of the real economy even if you don’t make changes to your portfolio. And in economics, stagflation is the devil.

Other Events

The pandemic era of quantitative easing and rising asset prices has fizzled out. In Q1 22, $118 billion worth of IPOs and additional share offerings were completed, compared to $480 billion in the Q1 21. Various Wall Street banks have reported double-digit declines in revenues and profit.

Charlie Munger, Buffett’s long-time friend and an excellent investor in his own right, has dumped half of his stake in the Chinese e-commerce giant Alibaba on behalf of the Daily Journal Co.’s portfolio. His ownership of the firm was seen by many as a validation that Alibaba was a safe investment. I presume that we will never know the exact reason for this sale, but it shows that each person must rely on their own work first and foremost.

The French lender SocGen has sold its stake in the Russian bank Rosbank to Interros Capital, which is linked to the unsanctioned Russian oligarch Vladimir Potanin. It will write up a $3.3 billion loss on the transaction.