Thesis overview.

Powerboat firms are priced like melting ice cubes under the assumption that the boating cycle has peaked. I would disagree. These firms are in very attractive businesses with moats, have had excellent performance, and the demand for their products has continued past the pandemic due to macro trends (work-from-home, rural-urban migration, earlier retirement) which has resulted in record deficiencies in dealer inventories. These drivers, I think, will continue to support financials in the near to medium-term. Market leader Malibu, in particular, stands to benefit the most; the company’s vertical integration alleviates supply chain issues and it has the pricing power to pass cost inflation onto consumers via surcharges (and consumers still remain eager!). There are risks, of course. But I think the chance to purchase Malibu at a ‘growth for free’ valuation is too attractive to pass up.

Valuation.

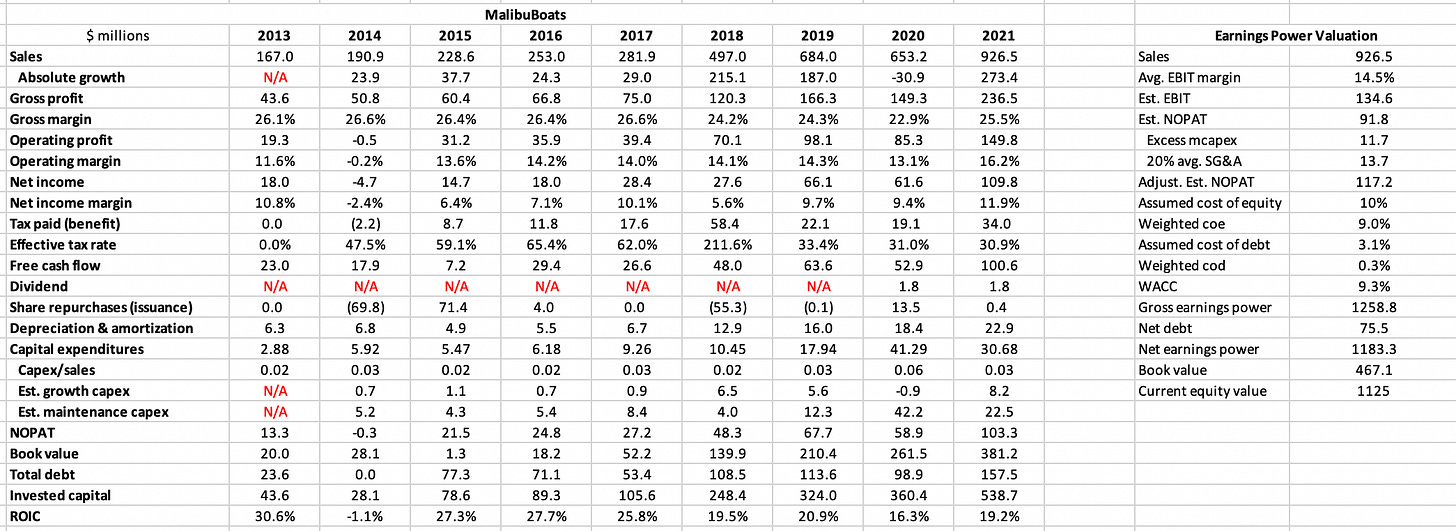

Malibu has grown revenue and operating earnings at compounded rates of 21% and 26%, respectively, between 2013-2021. Now consider that the firm trades at a EBIT/EV Yield of 9.1% and FCF/EV Yield of 8.3%, and a forward EV/EBIT of 5.2x. On an intrinsic basis, I estimate Malibu’s earnings power value (sustainable and distributable earnings, no growth assumed) at 1.2 billion, which about matches the firm’s market cap, and is more than double its book value, suggesting barriers to new entrants. That is despite the aforementioned past growth, desirable qualitative factors, a very high and consistent spread of returns on capital over costs of capital, and expected future growth (high probability, in my opinion).

The business.

Malibu Boats is a designer, manufacturer, and marketer of diverse powerboats. It operates via three segments. The Malibu segment consists of performance sports boats (PSBs) and envelops the premium Malibu and more affordable Axis brands. 17 models are produced in this segment; boat lengths range from 20-25 feet, and retail prices lie between $65,000 to $215,000. The firm holds the leading market share in PSBs in terms of unit volume in the U.S., at 31.7% in 2020 (up from 24.5% in 2010). This significant increase in market share, paired with a double-digit compounded growth rate of the overall United States PSB market since 2011 illustrates the strength and attractiveness of Malibu Boats’ positioning here. These brands offer extensive customisation and optional add-ons to prospective purchasers and contributed around 50% of sales in FY21, at high margins. PSBs are often used for skiing and wakeboarding.

The Saltwater Fishing segment includes the Pursuit, Cobia, Pathfinder, Maverick, and Hewes brands. 42 models are available in this segment, with models priced at circa $45,000 at the low end (Maverick and Hewes) to $1,200,000 at the luxurious high end (Pursuit). Saltwater Fishing boat lengths fall between 16 to 44 feet. In terms of unit volume market share, Malibu is among the leaders in this segment. But in contrast to the PSBs, the market for outboard and fiberglass sterndrive boats has grown at a lower compounded rate of 5% since 2011. Saltwater Fishing accounted for 26.2% of sales in FY21.

The Cobalt segment describes the Cobalt brand of high-end, premium sterndrive and outboard cruisers. 16 models are offered here at lengths of 22-36 feet; retail prices range from low ($65,000) to high ($500,000). Malibu Boats, via Cobalt, holds the leading U.S. market share (unit volume) in the 24–29-foot sterndrive niche of the wider market (about 36.1% versus 14.2% in 2010, and circa double that of the nearest competitor). Cobalt brought in 21.6% of Malibu Boats’ revenues in FY21.

Malibu’s moat.

In contrast to a direct competitor with extremely similar financials - MasterCraft Holdings - Malibu Boats is somewhat vertically integrated, which I believe constitutes a solid competitive advantage. To elaborate, the most expensive and complex component in the manufacturing process for powerboats is, of course, the high-powered engine itself. Powerboat manufacturers’ gross margins are therefore vulnerable to changes in the terms of engine supply contracts and supply-chain snarls (as we see now, due to the pandemic).

It helps, then, that Malibu has designed and manufactured its own line of ‘Malibu Monsoon’ engines for integration into the Malibu and Axis PSB brands since 2019, albeit the engine blocks are still ordered from General Motors under a contract that expires in 2023 (see this video for a refresher on internal combustion engines, and view the Malibu Monsoon page here). In addition, Malibu manufacturers its own towers (the inverted U-shaped structure above the cockpit to which water-skiing lines are attached), trailers, soft grip flooring (for the Malibu, Axis, and Cobalt brands), and certain machined and billet parts. In sum, Malibu Boats’ in-house manufacturing increases the firm’s bargaining power when sourcing components, reduces reliance on critical suppliers, reduces costs, and increases efficiencies, design freedom, and incremental margins per unit.

Malibu Boats has a large, international dealer network that I believe constitutes another competitive advantage and a barrier to new entrants. The firm works with more than 300 dealers in North America and anther 100 across Europe, Asia, the Middle East, South Africa, and other geographies. The agreements with dealers are one to three years in duration, but the relationships are longer term; 50% of dealers have been with Malibu’s brands for more than 10 years. The top 10 dealers accounted for 39% of sales in FY21, which I think is an acceptable degree of dependence. With its scale and strength of operations, Malibu can demand that dealers fulfil certain performance standards - ensuring a pleasant, superior customer experience - and offer them attractive incentives to sell its boats. These include conditional rebates (refunds that function as discounts), normal seasonal discounts, and floor plan financing arrangements. Smaller competitors in this fragmented market cannot match these incentive offerings and have far less bargaining power than Malibu does. It would also take new entrants years to establish fruitful dealer relationships. So, whilst smaller firms struggle, it is Malibu’s boats that spin in the showrooms.

A note on floor plan financing (FPF) and powerboat dealers’ incentives, which are important to understand. Powerboats are big-ticket items, and so dealers often purchase them on credit (the FPF arrangement). When the boats are sold, dealers return the principal plus interest to the lender (there is a sale price markup, of course, to secure a margin). Malibu offers to cover the FPF interest payments for dealers if the latter purchase boats in the off-season until either a) the boat is sold or b) the current model year ends. This arrangement balances out Malibu’s manufacturing across the year, which results in production efficiencies (win, win); around 80% of shipments to North American dealers in FY21 included incentive deals of this nature. Now, repurchase agreements are often embedded in these off-season contracts in case dealers do not manage to sell the boats. This seems like a risk as Malibu could be forced to repurchase its boats and sell them on at a loss. But these repurchase contracts are subject to reduction based on condition and age, and historical losses have been less than 10% of the initial invoice price - so no concern there.

Malibu has been on a successful M&A streak, and valuations seem acceptable considering these firms were all leaders in their markets. Let me illustrate. Cobalt, which produces luxurious sterndrive and outboard cruisers, was acquired for $130 million in June of 2017. Then, the firm had $140 million in sales, the number one market share its niche at 29.5% (double that of the nearest competitor), a strong brand, top dealers, organic growth opportunities, was profitable, and brought $18 million of future tax benefits to the table. Second, Pursuit, which makes high-end outboard fishing boats, was acquired for $100 million in October, representing 6.5x EBITDA and <1x sales of $124 million at the time. Pursuit held the #2 market share in offshore, #4 in dual console boats, and #15 in 24-43-foot centre console boats. Third, Maverick Boat Group (MBG) was purchased for $150 million in December of 2020. MBG had the #1 share in flats boats, #4 in bay boats, #6 in dual console, and #8 in centre console boats (though no multiple or sales were disclosed).

Going forward, management continues to target firms with leading market shares, strong cash flows, and experienced and synergistic management teams and workforces. I think M&A makes a lot of sense in this market because it is fragmented and returns on capital for established firms are very high and in excess of costs of capital.

Drivers.

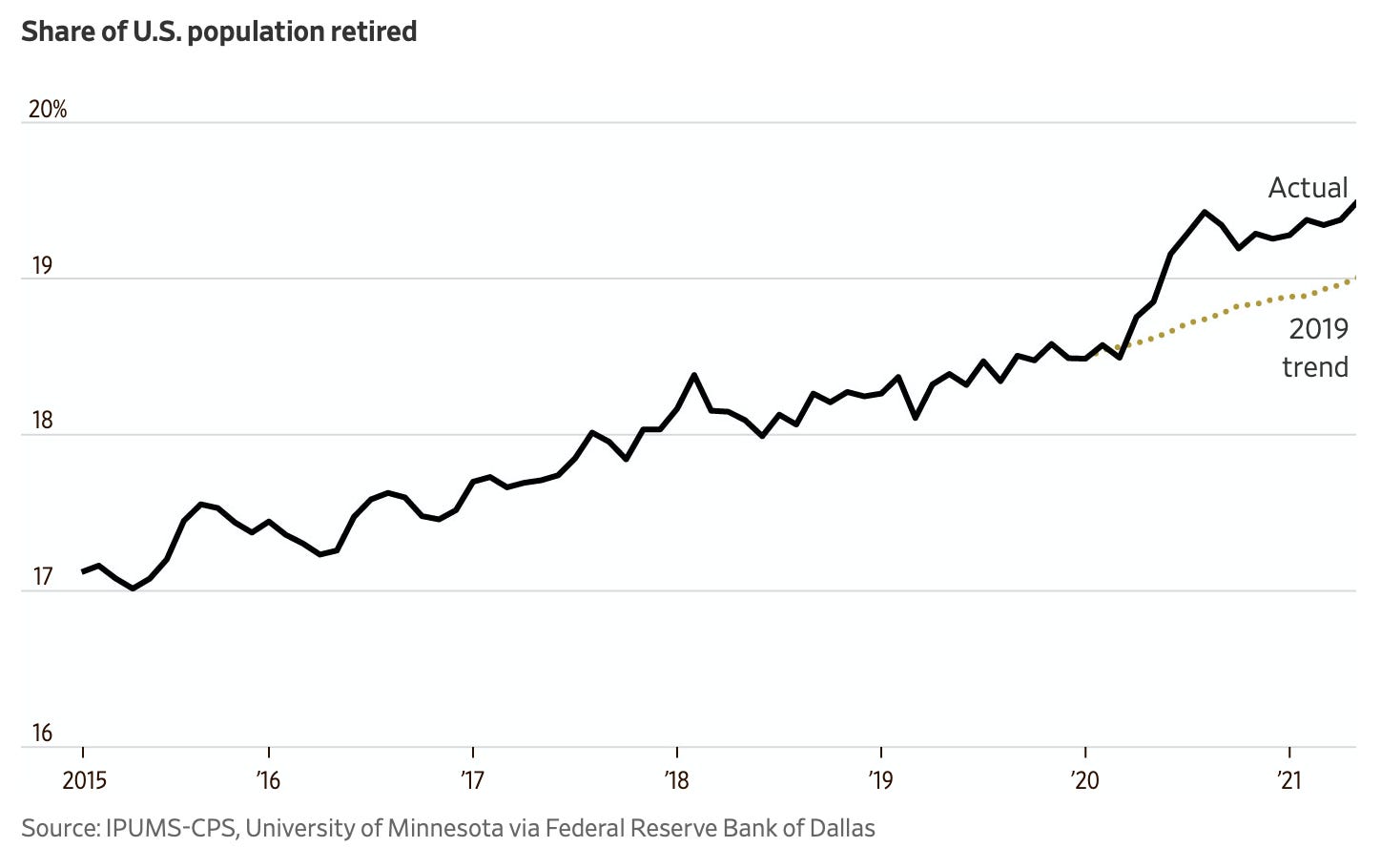

I believe pandemic-induced changes, the ‘retirement effect’, and low dealer inventories will strongly drive demand for powerboats in the medium-term. The option to work-from-home and intent to flee lockdowns and cramped metropolitan areas has resulted in a migration to more rural, non-metropolitan zones in the United States and elsewhere. That could create more opportunities and time for recreation and water sports, supporting boat sales. Moreover, lots of ‘baby boomers’ retired earlier than planned during the pandemic due to the spike in asset prices, so there are more retirees than normal seeking fun activities, and what could be more attractive to grandchildren than being strapped into a water-skiing harness?

However, the final point about dealer inventories is the most important because it offers the strongest assurance of continued demand. In their discussion of Malibu’s excellent third quarter results, management said that dealer inventories in terms of weeks on-hand remained 13-weeks below historic lows, and that it could be 2024 before levels normalise. This large backlog of orders creates peace of mind for the near-term at least, and illustrates how the ‘peak boat’ thesis and valuation does not capture the state of business well at all.

“[the boats are selling like] flapjacks, flying off the griddle at an IHOP.”

Malibu CEO, Jack Springer, Q3 Earnings Call

Malibu’s largest dealer reported that same-store sales were up 8% YoY, and data from the National Marine Manufacturers Association shows that there were more than 415,000 first-time boat buyers in 2021, which is just the second time that 415,000 has been exceeded since pre-recession 2007. This figure can be further divided into the 360,000 who purchased used boats (a significant proportion of whom will purchase a new boat in coming years), and the 56,000 that purchased new boats (this number is still 12,000 over the long-term average of 44,000). So, the demand is there, and at record levels. The main obstacle to ramping production continues to be the snarled supply chain, and I think Malibu is better able to handle this than others due to its vertical integration efforts. Malibu also has enough pricing power to pass on rising costs to willing consumers via surcharges; the average revenue per unit has risen 20.7% in the third quarter YoY to $134,400.

Risks and other considerations.

There are some clear risks that should be weighed. Rising rates could reduce demand going forward as I would assume that consumers often purchase expensive powerboats on credit. Furthermore, high oil prices have, of course, caused a jump in gasoline prices, and consumers could become unwilling to purchase another machine that requires expensive refuelling. However, I think the elephant in the room is that powerboats are, first and foremost, a consumer item. If the central bank experiment fails and causes a recession, this is a product that will be right at the bottom of the shopping list. It is reassuring, though, that declines in new powerboat retail units sold in run-of-the-mill recessions are often between 10-20% which seems manageable, and that Malibu is well capitalised (net debt of $76 million), has a cycle-tested management team, and cost structures that can be adapted to different demand environments.

There are a handful of other factors which warrant discussion.

Malibu’s management owns 2% of shares and is incentivised to produce adjusted EBITDA growth and a superior TSR relative to the Russell 2000 (index-relative TSR is, I think, used because few of Malibu’s competitors are public).

1.7 million shares are reserved for management under the long-term share incentive program, which equates to a substantial 9% of outstanding shares.

A $70 million share repurchase program has been authorised, of which $41 million worth of firepower is still available (corresponding to about 3.6% of shares at $56). No dividend is paid, but this makes sense because returns on capital are so high - I would rather see reinvestment into the business.

Some might point out that Malibu trades at an almost identical valuation to MasterCraft on both a multiples and intrinsic basis, and that the latter could be a better investment. I think that this argument is credible; MasterCraft has strong market positions and organic growth opportunities (e.g., the luxurious Aviara brand, which was developed in-house), and makes for an attractive M&A target. But Malibu is still the PSB market leader, and its vertical integration (MasterCraft has none) is a clear competitive advantage in the current supply chain environment, I believe. Regardless, a split allocation between firms is still worth considering and seems reasonable.

Catalysts.

Realisation that Malibu is riding several tailwinds and seeing record demand as indicated by Q4 and FY22 earnings releases.

Insider purchases by management.

Disclaimer: this write-up describes the author’s own research and opinions, and does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I hold a material position in the issuer’s securities.