Somero Enterprises (SOM)

Dominant in the niche of high-tech concrete screeds...

Business Description

Somero Enterprises (SE) designs, assembles, and sells industry-leading, laser-enabled, high-tech screeds, which are used to level concrete for perfectly smooth surfaces. It has a worldwide customer base of thousands of general and specific concrete contractors, with no concentration risk. SE sells both directly and through a network of external representatives and independent dealers. As the market leader, SE has delivered a 10% organic sales CAGR since FY13, with an average EBIT margin of 27% and ROIC of 34%. Representative cash conversion (OCF/EBIT) stands at a solid 84%.

In FY23, 73% of sales were to North America, with 14% to EMEA and 13% to Rest of World. Average YoY growth has been highest for North America at 17%, with EMEA at 13% and RoW at 10%.

Typical use cases for screeds are the construction of logistical warehouses, production plants, car parks, hospitals, schools, retail centres, etc. Hence SE’s end-customers include blue-chip, tangible asset names like Costco, Walmart, Amazon, Mercedes-Benz, Tesla, Coca-Cola, etc.

SE’s product portfolio includes 20 models, and FY23 sales contributions by product line were Boomed Screeds (45%), Ride-ons (17%), 3D Profiler (7%), Remanufactured (6%), and Other (26%). Product replacement cycles are long, between 5 to 10-years, and Somero takes trade-ins, replaces their wearables, and sells them on to smaller budget customers (the Remanufactured line).

It is not uncommon for contractors to purchase several machines as needed for tenders (different machines for different slab sizes), and prices likely range from $50-550k, making them the largest expense for customers before the concrete itself. SE also offers services like maintenance and repairs, spare parts, training for operators, and a dedicated support hotline (a degree of recurring revenue).

SE delivers a strong value proposition. Traditional methods to flatten concrete involve either handheld screeds or even a simple wooden plank to spread out the mix of water, sand, aggregate, and cement evenly. However, these methods are unreliable, old-school, labour intensive, and slow.

Commercial floor quality is critical and regulated, for obvious reasons. Picture the interior of an Amazon fulfilment centre, with vertical racks supporting bulk pallets to the ceiling, and forklifts circulating. The floor is under extreme stress, and if uneven, could cause racks to collapse, wear down equipment, and compromise the safety of operators; deviations of even two-millimetres in a typical warehouse can cause such problems.

SE’s screeds allow contractors to install high-quality concrete floors at least twice as fast, with half the staff count, and marginally less excess concrete. For end-customers, floor and equipment maintenance costs are reduced significantly, operational efficiency is increased, and aesthetics improve.

As to the supply-chain, SE is partly vertically integrated, with some processes completed in-house e.g., sandblasting, painting, etc. But most components are sourced externally, and then assembled in a single, 54,000 sqft facility in Michigan, U.S. Information on supplier concentration and origins is not available. But like other companies, SE built up reserve stock during the pandemic.

This is a good business model, for several reasons.

First, SE sells to concrete contractors, whose business is very competitive and low-margin. With no moats, these customers depend on maximising efficiency, and with cost-plus pricing, the lowest cost operator is likely to win tenders. As testimonials have shown, screeds significantly reduce costs, and SE has an active focus on engaging with contractors to make this relationship work. For example, SE invites them to contribute to innovation councils. The cost of failure is also very high, as contractors depend on a successful track record to win business.

Second, SE benefits from a meaningful moat through patents, scale, and support. Third, the niche nature of its market means that entering it would not move the dial financially for larger players like Caterpillar or Komatsu, who have huge financial resources and in-house expertise.

However, cyclical exposure to the non-residential construction market and the non-recurring nature of sales (with long lives and limited service needs) limit the model. Moreover, though SE is the dominant player today, besides the requirement to retrain the operator, there is no meaningful switching cost similar to what we would see in, for example, very complex surgical equipment or deeply integrated software.

This means the onus is on SE to be both at the edge of innovation and offer acceptable prices; high-tech screeds are the biggest cost for contractors, and the higher their price, the lower the associated cost reductions (natural limit to pricing power). Indeed, per management, almost all of SE’s products are sold at a discount. This is not encouraging. Relatively low penetration of automated screeds also means that not having them is not a disaster; demand should not be considered inelastic.

Market and Competition

Though SE does not report its true penetrated market share (private competitors), it is likely very high (>80%). This is because management has frequently and directly cited very limited competition, and there is the strongly indicative combination of high margins and ROIC.

Research shows that most competitors that sell screeds do so alongside a wide range of unrelated equipment (generalists), and exclusively offer smaller-scale versions, like manual vibration screeds, which are especially common in smaller-slab construction.

Those that compete more directly with SE, with full screed portfolios, some of which are laser-enabled, are often defendants in SE’s record of patent infringement lawsuits. Ligchine is one U.S. competitor. It offers boom, ride-on, material placement, 3D positioning, and refurbished products, and counts 7 designs and 24 patents and applications (SE has >120), with an international dealer network. Estimated revenue for Ligchine is around $20m. It is also curious that one of SE’s directors, Howard Hohmann, shares his surname with Ligchine’s president, Kyle Hohmann, and that the latter worked for Somero as a territory manager from Dec 06 to Apr 08. If those two are related, I would want to listen in on their dinner table discussions.

Masterscreed is an Italian firm specialised in ride-on screeds, and so is Topp and Screed, a competitor in Luxembourg. There are some Chinese competitors who sell at deeply discounted prices, but the quality of their machines is unlikely to match SE’s. Other than SE, no pure-plays are publicly traded. On first sight, the size of direct competitors seems far smaller, though their financials are unavailable.

SE is primarily exposed to the extremely large (likely trillions) non-residential construction market, which spans commercial, infrastructure, industrial, and institutional developments. This market, where the U.S. is the largest component, is likely growing at low- if not mid-single-digits, with general drivers being fleet additions, shortages of skilled labour, technology upgrades, ecommerce, and on-shoring of production. In terms of specific drivers per region, electrification is demanded in Europe, and both Europe and Australia are seeking more parts and services. In Rest of World, high-quality concrete floors are a priority in itself.

However, the non-residential construction market is not the TAM for SE, and specific and reliable numbers for the construction equipment market, let alone the automated screed market (1:1), are not available. What is certain is that SE’s own growth depends almost entirely on more penetration instead of overall market growth or winning market share. Indeed, it holds at least 80% today, which at this level of penetration would suggest the entire market is sized at $151m.

This is a rounding error in the presumed construction equipment market size (dozens if not low hundreds of billions), so we can infer that traditional methods are still very common (and more so in emerging markets). Moreover, we can safely assume that the fully penetrated market size is at least multiples of the current revenue base, so there is a long runway. SE’s target, then, is to impress its value proposition of more productivity and profitability on concrete contractors, encouraging them to switch to upgrade to partly automated screeds.

A brief note on concrete itself. Due to its strength, versatility, fire retardance, affordability (aggregate, sand, and cement are abundant raw materials), insulation, durability, etc., concrete is the most popular construction material, and second-most-used substance worldwide after water. Concrete cannot be laid in wet weather, and though cement production accounts for about 6% of global carbon dioxide emissions, it is very unlikely to be replaced in the near future. Steel has a higher tensile strength but is much more expensive, and brick and stone is too labour intensive and harder to work with, with plastics and composites still a nascent market and a similarly expensive choice.

Competitive Advantage

SE’s economic moat can be split into three parts.

First, SE pioneered the Laser Screed in 1986, and has focused on organic, internal research and development ever since (acquisitions are considered but opportunities are few). This has led to a portfolio of >120 patents and applications, which it very actively defends through infringement lawsuits. These make it difficult for competitors to innovate and imitate without legal penalties (perhaps a patent thicket exists).

Second, as the largest specialised player in this market, SE can outspend competitors in research to remain ahead of the curve, though benefits of economies of scale and operating leverage are attenuated through the high share of variable costs.

Third, SE has a very effective global support network. From customer testimonials, it is clear that worldwide support in less than 10-minutes and in 10 languages 24/7/365 is a big differentiator, seeing as concrete sets in an hour, and contractors are always under pressure to complete their work as fast possible. SE can also offer next-day, global delivery of spare parts.

Strategy

SE’s long-term strategy is continued international expansion and internal product development. As to the latter, recent launches include electric machines like the S-940E (a total of three planned for CY24), and product acceptance cycles can be very long, at up to 10-years per management (see Sky Screed story). This skepticism of buyers is logical considering the high price tag of these machines.

Execution so far has been very good, with a consistent increase in patents and applications, products, and steady growth across international regions. New customers represented 18% of revenue in Europe and 43% in Australia in 1H24.

Management, Incentives, and Ownership

SE’s management features very long tenures and old age. Jack Cooney, who has been CEO since Dec 97, is aged 78; the chairman, Lawrence Horsch, signed up in Oct 09 and is aged 90. The exception to this aging trend is the CFO, Vincenzo Licausi, who started as an employee in Sep 18 and is 50 years-old. Jack Cooney has publicly stated that he will retire soon, once he has found and trained a new president (search should conclude within the year).

Cooney will receive a cash salary of $609k in FY24. The bonus is likely based on EBITDA (not confirmed), with a cap of 100% of base, and managers can elect to receive it in stock. Where it gets odd is with the long-term incentives, where stock awards are based on tenures, not performance. Specifically, awards at 40% of annual salary are granted in each first quarter, provided three-years of service. As to the reasoning behind this:

“[the] plan was implemented in part due to the significant difficulty for US-based employees to access the AIM market due to securities legislation and administration issues. This plan has resulted in a steady increase in equity ownership across Executive Directors and Key Managers.”

It is understandable that the AIM is not easily accessible for U.S. investors, but surely this explanation is incomplete. If RSUs can be granted, why not with performance conditions attached? Very odd. It also strange that management has opted for such a high payout ratio when it could reinvest that capital at excellent returns (more R&D, expand support, marketing, and advertising further?). This might suggest complacency.

Insider ownership is minimal, with Cooney owning about £1.7m of ordinary shares outright and the CFO £188k. Additional stakes from RSUs held are not significant, with $361k for Cooney and $159k for “Enzo” Licausi at the current price.

SE’s ownership base is fragmented and comprised of small institutional funds: the largest individual stake is 7.6% and the smallest in the top ten is 3.1%.

Recent Trends

For SE, the North American market has seen concrete availability problems and chronic labour shortages, which have forced contractors to execute slowly on what is otherwise a healthy backlog. Postponements through expectations of lower rates (debt financing is very common) are also prevalent; in particular, this is true for the largest contracts that demand boom screeds.

Europe has not faced these issues, and work in Australia was affected by unfavourable weather trends. FY24 revenue guidance is for $110m (down 9% YoY), and a 15% workforce reduction was implemented to protect margins. An improvement is expected for 2H24, partly through another product launch.

Risks

The primary risk for SE is a huge and unpredictable cyclical downturn. Though this has been modelled in the recession scenario based on the dire GFC happenings (see Valuation), producing a theoretical downside of -8%, this is, of course, a mere approximation. The illiquidity of this stock could also magnify swings past this point.

Another risk lies in product development. SE needs to continuously innovate to create appealing products for concrete contractors; it cannot skimp on research or surf on historic assets if the competitive position is to be maintained. Failure to accurately anticipate customers’ needs or a market reluctance to adopt new launches would definitely be problematic and could result in significant impairment charges.

Valuation

Considering the cyclicality of the business and what can be a long slog of market penetration, it makes sense to value SE on three scenarios: a disastrous recession identical in magnitude to the GFC, zero growth (earnings power value), and a conservative blue-sky case. SE now trades at 10x NTM earnings.

The disaster scenario is modelled on the GFC. Assumptions include: successive sales downturns of -25%, -50%, and -10%, starting in FY25, with a three-year subsequent recovery, such that sales are back at the FY24 level in FY30, and then a 5% YoY CAGR going forward; capex at the lower end of maintenance in the downturns, at $1m, then at 3% of sales; expenses at higher proportions of revenue than usual in the recession period (accounts for lag in variable cost reductions); and the bridge to OCF is based on average 84% OCF/EBIT conversion. At an exit multiple of 6x EBITDA (historical average), this results in a price target of £2.7 (8% downside), with a WACC of 10% to reflect cyclicality risk but an otherwise high-quality business.

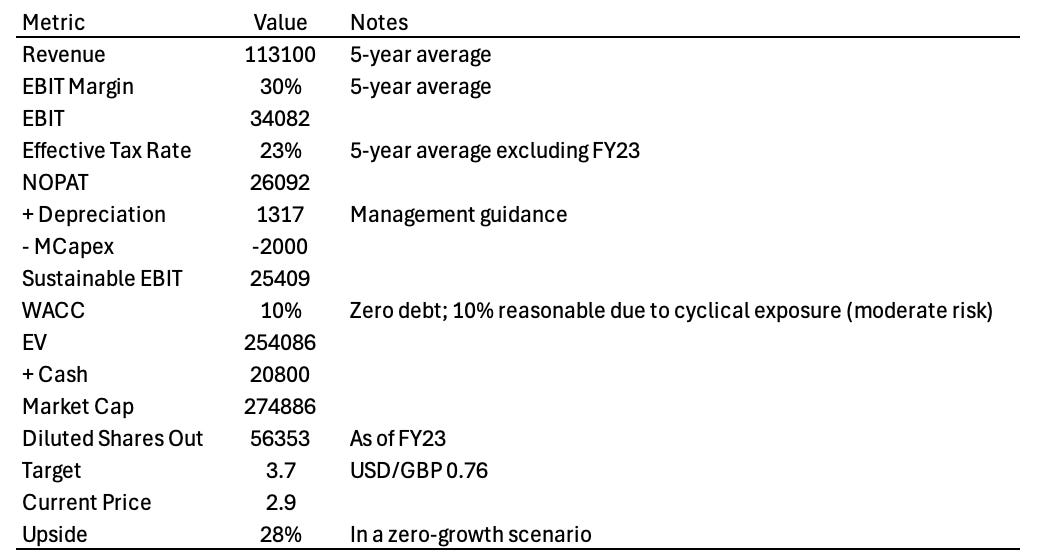

In the zero growth scenario (earnings power value), 5-year averages are used for sales, the EBIT margin, and effective tax rate. This is also true for depreciation, which is added back, with $2m in maintenance capex deducted (management guidance) to obtain sustainable EBIT of $25.4m. Adding net cash, the price target is £3.7 (28% upside).

Finally, the blue-sky growth scenario assumes 5% YoY growth as of FY25, which is half the CAGR of the past 10-years. As in the disaster scenario, OCF is still based on the historical 84% OCF/EBIT conversion. This indicates upside to £4.4 (or 53%).

Altogether, weighting scenarios equally, the target is £3.6 (24% upside). The LTM dividend yield is >8%.

With its cash generation and fragmented shareholders, SE is also a very attractive target for PE. This is validated by the fact that SE itself was listed by a PE firm, and that Ligchine has been hot-potatoed between private investors also.

There is also a lot of potential for multiple expansion, which could manifest through a second listing on a U.S. exchange; AIM is difficult for U.S. investors, and the small-cap investor base over in the U.S. is surely not weaker than in the UK. I do not understand why this has not been done so far and is not obvious to management.

Conclusion

Somero is a quality company in a niche market with an excellent financial profile. However, the case is weakened by the reluctance of management (so far) to pull what are obvious value-creating levers, like a second listing on a U.S. exchange, and reinvestment of its strong cash flow to strengthen its moat and accelerate market penetration. Though the current valuation at a 6x EV/EBITDA exit multiple indicates undervaluation, the margin of safety is too small, and I do not feel comfortable betting on changes in management policies (in particular, multiple expansion through a second listing) or macro developments like lower rates. The non-recurring nature of sales is also not ideal, and I do not feel like I understand either the concrete contracting business or unit economics well enough.

Disclaimer: this write-up describes the author’s own research and opinions. It does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I do not have a position in the issuer’s securities.

Great write up, I have been following them for a little while. I think they are a great PE target but they have been for a long time, so why has no one bitten? a secondarily is US would also cause a significant re-rating but until their is a a management change I cant see this happenging.

Like Journeyman, i‘ve also a position in them. The profitability is massiv, even in downcycles margins are extremly high.

Thank you for the big picture and detailed writeup! I will subscribe!