Howdens Joinery Group (HWDN)

The UK's largest supplier of kitchens has wonderful financials but has been sold-off in recent months.

Dear investors,

Howdens appears to be a wonderful business at a fair price. It has shown strong historical growth, has an excellent value proposition for its customers, and moat-like attributes that have blessed it with 20-40% returns on invested capital. Management is prudent, and innovative, and the balance sheet is strong. Investors have sold off the shares due to recession fears that have plagued other firms which provide consumer products too. But at an EV/EBIT of 10x and with growth levers at the firm’s disposal, I think it makes sense to build a position.

The business.

Howdens is the largest supplier of kitchens in the UK, with a 1/3 share of this £5-6 billion market. Howdens has a simple, decentralised, efficient, and powerful business model that spans manufacturing, distribution, and wholesale. Kitchens are complex furniture and consist of multiple individual units such as sinks, appliances, cabinets, drawers, extractors, splashboards, etc., that are assembled to form a whole.

Howdens manufactures all of its own kitchen cabinets - circa 4.5 million units per annum - alongside some worktops, cabinet frontals, and skirting boards. This translates to 1/3 of total kitchen units, and a high degree of vertical integration. The production of the other 2/3 of kitchen units is outsourced to suppliers with whom Howdens has good, long-term relationships. Insource/outsource decisions are reviewed on a constant basis; if at one point something can be made cheaper and or better in-house, Howdens will do so.

Once made, the components are transported from factories and warehouses to more than 789 depots across the UK and 39 in continental Europe and Ireland (almost all in France) via Howdens’ own logistical network. Howdens’ depots have between 8 to 10 well-incentivised staff members that are paid from the local profit pool. To be specific, managers receive 5% of the operating profit and the rest of the staff split 5% of gross profit. Hence better business equals more reward. The average floor space of a depot is 10,000 metres squared - there is a minimalist reception for customers - and depots are located on the outskirts of towns. This placement is intentional: it assures cheap rent relative to retail and makes access practical for local tradespeople who install the kitchens in the end-users home. In fact, 85% of tradespeople live within 5 miles of a Howdens depot. It is critical to understand that Howdens exclusively sells to small builders via its depots, and no other entities. Ecommerce platforms like Amazon are not used as a sales outlet.

Howdens has an excellent value proposition for its customers. It offers convenient and quick access to high quality, low-cost products that are 100% in-stock at all times; confidential discounts that help builders choose their margins and make ends meet; excellent customer service; and up to 8 weeks of trade credit, allowing builders to get on with their projects as soon as possible. Howdens also has 1,600 kitchen design specialists help end-users make design choices and plans via face-to-face or online meetings - providing even more value to builders.

A win-win relationship like this benefits all: Howdens gets paid when builders get paid and the latter advertise for the firm. Yes, Howdens might have ‘captured’ these small builders - it has a much larger share of the tradespeople-exclusive kitchen market than its overall 1/3 market position mentioned earlier - but the firm is customer-obsessed and chooses to cooperate instead of abusing its dominance. The proof is in the pudding: Howdens presides over 450,000 trade accounts, and therefore supplies 1/3 of UK tradespeople (1.4 million total) with kitchen units. End-customers are also satisfied with the kitchens, with online reviews being excellent across the board.

A note on depots, which are the heart of this business. Howdens has added about 25 new depots per annum since 2009 at a 4% CAGR, and now has 827 in operation.

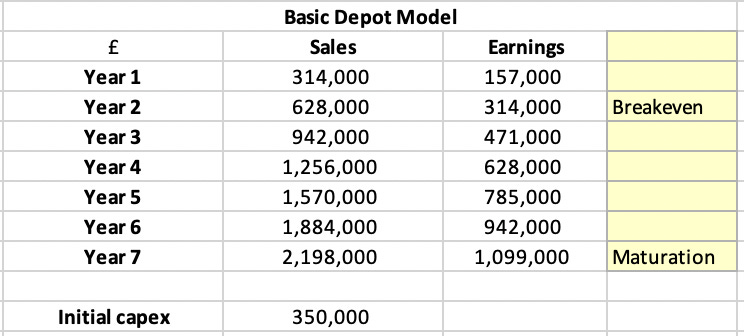

These depots cost a mere £350,000 to set up and breakeven is reached in 2-years. In addition, sales increase in a linear fashion until maturation at 7-years post-construction at £2.2 million. Howdens has never closed a depot for economic reasons.

Thus, Howdens sales growth stems from the maturation of existing depots and the opening of new ones alike. This is a delightful tailwind.

Thesis points.

Howdens has a high-growth, attractive historical financial profile. To illustrate, sales and operating profits have increased at compounded rates of 8.7% and 13%, respectively, since 2009, with returns on invested capital of almost 40%. Gross margins are at 60%, with operating margins between 16-20%. All of these numbers are stable, too.

The obvious question is as follows: can the firm continue to grow? I am confident that it can, for two reasons.

First, management sees potential for 950+ depots in the UK alone (an addition of 120 from current numbers), and due to the evolution of depot sales this would provide a big boost to sales. Let me illustrate. If Howdens builds 25 depots per annum until Year 4, and 20 in Year 5, we would have those 950 UK depots. Additional depot sales under this plan can be calculated as sales provided by new depots plus the sum of sales provided by older depots (the latter are on a constant increase in this period due to the linear maturation mentioned earlier). Thus, in Year 5 of this plan, Howdens would have won an additional £116.6 million in sales (6% of 2021 sales). This might not seem like much, but consider that these depots are not mature in Year 5. Once maturation is reached, sales produced by these 120 planned depots would equal £263.8 million (13% of 2021 sales).

Second, these figures exclude the significant expected sales addition from the French expansion (the above plan for new depots is UK-specific). Howdens’ sales in the French depots have increased since 2015.

Whilst Management has admitted that the French expansion has been slow in the past - the CEO called it the “longest time trial”, albeit with humour - the pace now appears to accelerating. Indeed, in the latest earnings call, the CEO outlined plans to build two depots per week in 2022 and suggested that a total of 100 would be reached. He also expressed confidence in the “very strong leadership team” and said that the managing director there was rolling out “new product innovations” - there are some differences in French and English tastes regarding kitchens - with a big range launch planned for 2022. Livingston also said that “[French] builders are understanding [the] model”, which is important. Most of the French depots are around Paris, and Howdens will concentrate on the “big regions”.

See the below quote.

“We're the only ones on the ground really with quality product in stock on local occasions, but that is being appreciated. And we see more similarities between the UK and France, and how builders want to trade with us. A great product, easy to install, great prices, and the whole thing is incredibly convenient. So, we're lifting all of our platform capability and putting in France.

So yes, we're pushing forward with it. We will do a depot nearly every two weeks this coming year and it's going on like that. So, key that we keep the city based approach in France, given the nature of the country. So, we will be concentrating further on Paris, I said 40 around (inaudible) France area. But North Border or big regions is where our concentration will be and we'll get up over a couple of hundred depots, we'll see where we're at. But yes, feeling confident about it.”

- Andrew Livingston (CEO), FY2021 Earnings Call

Based on the latest information, Howdens now has 34 depots in France. If we assume that Howdens adds 26 new French depots per annum going forward, then the 100-depot threshold referenced above would be exceeded in 3-years, at 112 French depots in operation.

Now onto the basic model. Dividing the total French depot sales of 2021 by the number of current French depots, we get £1.7 million in average sales per French depot. This means most are quite close to sales maturation, and I will therefore make the simple assumption that each produces £2.2 million in sales in the future. In Year 3, then, under the current French expansion plan, Howdens would reap £123.7 million in additional sales (about 6% of 2021 sales). Again, if we assume all of these new depots mature to £2.2 million in sales, the ultimate sales gain could be £246.4 million (around 12% of 2021 sales).

In sum, with its current depot rollout plans, I believe Howdens could see a sales increase of 12% in the medium term (5-years), and about 25% in the longer term (5-10-years). However, this again does not include the maturation of a sizeable proportion of the 789-strong existing depot portfolio in the UK. This would, of course, add the most sales, but I cannot model this due to insufficient information. I therefore perceive these depot rollout plans as a very conservative growth projection.

Howdens is delivering on its strategies and initiatives, too. I will comment on five of the most important developments, in my opinion, and refer you to the annual report and other public documents for more.

Depot revamps. These involve vertical re-racking, which allows more units to be stored in less space and to be picked with more ease. The cost of this is £225,000 per depot, with an estimated breakeven in 4-years. The expense is charged to the local depot P&L, motivating staff to drive incremental sales increases (remember the incentives). 62 depots were revamped in 2021 (103 in total), and Howdens plans to revamp another 70 depots in 2022. At the end of 2022, management aims to have 55% of depots trading in this new format. Besides this, Howdens is experimenting with smaller depots that increase site options for less populated areas.

Refreshment of product offerings. 20 new kitchens will be introduced in 2022 and old ranges will be offered in new colours. In total, there will be 80 kitchen ranges to choose form in 2022, split into 9 different families. New kitchen launches have produced good returns in the past: in 2021, the 17 new ranges produced much higher sales than the older ones. Howdens will also shift its focus from low-priced kitchens - where it has had the most success - to high-priced ones, which could make a favourable contribution to product mix and margins.

Logistical improvements. Because the 100% in-stock model is so important to builders - it was a major reason that Howdens outperformed competitors during the 2021 supply-chain crisis - the firm has introduced regional cross-docking centres (XDCs) in 2020 that deliver stock replenishment each night. Without these, depots would be reliant on one restock per week. The XDC service will be rolled out to all depots in 2022, taking the total number to 12. XDCs also free up time and resources in depots and reduce the need for inter-depot transfers of stock.

Manufacturing investments have been made and more are planned. Howden will produce more of its worktops and doors in-house going forward now that a pair of acquisitions have been made. The Howdens plant will be expanded over 3-years by 25-acres to increase manufacturing capacities for cabinets and doors. The new lines will be operational in early 2025. A new distribution centre for units produced in-house will be constructed also, at Capitol Park near the Howden plant. This centre will increase storage capacity by 80% and allows the plant to focus on manufacturing, not storage; it will take 2-years to build.

Digital reach and innovation. At the time of the FY2021 report, Howdens reported an 11% increase in website visits to 24 million. Social media followers increased 49% to 400,000. 1.3 million users were engaged each month. As to the trade account, which gives contractors near full-service, new registrations in 2021 exceeded 100,000, which is very impressive. Tradespeople accessed these accounts twice per week, and outside of hours, too. Weekly logins on the platform were up 160% year-over-year. Average order value increased by 70% in 2021 and users viewing documents were up 41%. These are favourable trends. ‘Anytime Ordering’ was launched too, which allows tradespeople to see their confidential prices, order products, quote for individual jobs, and select pick up times and collection points outside of hours on their digital accounts. Howdens has a simple model, and I think all of these constant improvements are indicative of good, innovative management. The strong focus on cost-savings and efficiencies is commendable, too.

Howdens can cope with the current macroeconomic environment better than most. The firm has no debt (though lease liabilities are there) and has funded all of its growth with its own, substantial cash flows until now. Net cash stands at £75.9 million and the concern still has access to an untapped credit line of £140 million. The financial management of the firm has been prudent and excellent. Now, I believe Howdens faces three economic challenges: high inflation, supply-chain problems, and a possible downturn in consumer spending (I think the latter drove the recent share price decline).

I think the first two concerns are less problematic. Howdens has strong pricing power due to its market position and scale, which allows it to pass costs onto tradespeople via price hikes. Moreover, its significant vertical integration (about 1/3 of units are produced in-house) and efficient national distribution allows it to fill up depot inventories - the in-stock model is a core value proposition for tradespeople - and prevents full dependence on outside suppliers. Howdens skill when it comes to unit replenishment was a major reason that it outperformed rivals in FY2021.

As to the consumer spending issue, I believe this will be a short-term problem that can be weathered with a longer-term investment horizon. Furthermore, if we look to the financial reports during the financial crisis of 2007-2009, we see that sales declined 27% in this period, but operating profits increased almost 18%. The firm bounced back from that impact with speed, too, and I believe the business environment then was worse than it is now (though we do not know this for sure).

As a side note, some might assume that rising rates, which result in less new builds, will also damage Howdens’ business. But this is not true: Howdens obtains 90-95% of its sales from renovation projects, not new builds. Yes, a kitchen is a big-ticket item that must not be replaced unless it is broken. But it has an actual use - it is not recreational, in truth - and could therefore take precedence over other consumer product expenditures.

Until now, things are going well. In the latest trading update for Q1 2022, Howdens reported 22% sales growth (20% for same-depot sales) YoY. See the below extract from the update.

“The Group has traded well in the first four periods of 2022 and we continue to invest in our in-stock, trade-only, local business model. We are mindful that it is still early in the financial year and our second half includes our all-important peak trading period. In addition, given an uncertain macro-economic environment, including rising inflation and energy costs we are staying vigilant for any potential headwinds in our markets. However, we remain confident in our business model and with the strong start to the year, the Group remains on track with its outlook for 2022.”

- Andrew Livingston, Howdens CEO

It is important to know, however, that the all-important second half contributes most of the group’s profits and sales (Q4, to be specific, because consumer want their new kitchens done before Christmas). H1 results are coming on 21st July, and will provide the newest insights into conditions.

Howdens is shareholder-oriented. The firm has paid out an increasing dividend since 2012 and conducts regular share repurchases. It has a commitment to return all cash on-hand in excess of £250 million to shareholders, and has a £250 million repurchase programme in operation, of which £60 million has been completed.

Other matters.

There have been two recent insider purchases by the CEO and CFO at prices of 807 and 822 GBp. As a whole, insiders own 0.29% of shares.

Valuation.

There are no true public comps for Howdens and using UK retail index multiples would not make sense as an alternative because Howdens does not sell direct to consumers… it has a unique tradesman-focused model. Howdens now trades at 8.8x EV/EBIT and 10x EV/FCF. These multiples appear cheap to me, knowing the high quality of this business. View the financials below, where I have hidden the data from 2009-2015 - which is also stellar - because I could not fit it into this post without blur. Do feel free to email me for the full model.

I used a DCF to work out the bull, base, and bear intrinsic values for the firm. I modelled £100 million in future capex, which is the guidance given by management. Free cash flow was discounted at 9.2% using Bruce Greenwald’s rule-of-thumb approach to cost of equity.

At the current share price of 611 GBp, I feel this is a wonderful business at a fair price. I do not see any obvious catalysts, and this is not a ‘special situation’.

Risks.

The rollout of depots in France fails, for whatever reason. This is improbable after such an extensive testing period.

UK depots begin to cannibalise each other’s sales, which damages the business. Based on management’s conservatism in rollouts and clear knowledge of the firm’s model, I do not think this is probable. Besides, the depot model is so local that builders will not drive to another depot if 85% of them are 5 miles from a Howdens depot. If all items are in stock in all depots, who would bother with the extra distance?

A full-blown recession decimates demand for Howdens’ products and sends the stock into a downward spiral. The 2007-2009 scenario suggests that, even if this does occur, the firm will see a manageable downturn and a rapid rebound. The competitive landscape, too, could be even more favourable for Howdens post-emergence than it is now, as I think the firm will be one of few to manage such a crisis well.

Disclaimer: this write-up describes the author’s own research and opinions, and does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I hold a material position in the issuer’s securities.

From tag1989 on Reddit.

Very solid work!

1. I would agree with your very first line actually; it's a great company no doubt, but i would say it's currently at a reasonable (or fair) value - £6 or whatever it is a share. definitely not a bargain or cheap at present, but on the road to perhaps.

2. Obviously they had an excellent past couple of years with everyone being at home and doing renovations etc, so it will be interesting to see the knock on effect of rising costs (or strictly speaking, people diverting their money/savings to more essential needs) as well as rising interest rates and how they attempt to mitigate these as best they can.

3. I'll finish by saying that it's probably one of the few UK businesses in the FTSE 100 or 250 that is actually well ran, is forward looking, and knows exactly what they're doing.