Long Pitch: Edenred (EDEN)

Downside risks seem more than priced in at this point...

Investment Case

Attractive model with a real competitive advantage. Edenred’s B2B2C model is cash generative, delivers a high-margin, and has inherent operating leverage. Most of its earmarked solutions are prepaid, generating a negative working capital requirement and free float that can be invested for pure profit. Since FY11, Edenred has grown reported and like-for-like operating revenues by 11% and 8%, respectively, and at a full cash conversion. Meanwhile, the operating EBIT margin has risen from 27% in FY11 to 30% in FY23 and there is more upside through expansion of its product suite in margin-accretive business lines like corporate payments. Edenred’s competitive position is also secured through a powerful combination of network effects, software economies of scale, and economies of scope, and its grip on merchants is tight.

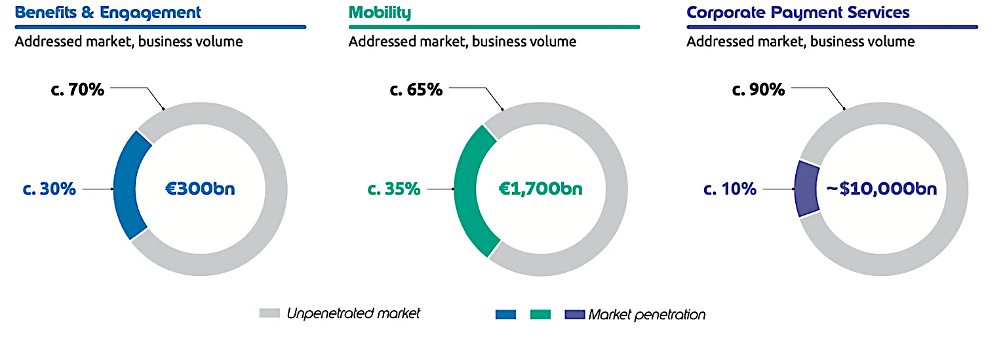

Extremely under-penetrated markets. Edenred’s TAMs, which range between €1,000bn to €25,000bn, offer a very long growth runway. Penetration rates are also still low at 10 to 35%, depending on the business line in question. This lowers customer acquisition costs, supporting favourable underlying LTV/CACs of >10x.

Defensive characteristics. Despite a global economic shutdown in 2020, Edenred lost a mere 10% of the prior year’s sales and 200 basis points of operating margin, and even returned to growth in 2H20. This is attributable primarily to some relatively inelastic end markets (LFL FY20 downturn of -1% in Mobility, -4% in Benefits & Engagement, and -12% for Complementary Solutions).

More regulation and legal consequences more than priced in. Because Edenred and its rivals have put the squeeze on merchants in the meal voucher space, the French competition regulator has made recommendations to the government that could reduce growth and profitability in France. Separately, an Italian competitor has accused Edenred of deliberate fraud in a public tender. I believe both risks are mitigated through global diversification. The second risk is stunted primarily by a favourable first-instance ruling and the maximum fine of €20m having been paid, and the fact that Edenred has not been accused of fraudulent tenders in the past (contagion unlikely). It also has thorough compliance procedures which are being strengthened further. Likely due to both concerns, investors have shaved off almost €4bn from Edenred’s market cap since the Italian press release, which seems too pessimistic considering the firm’s prospects.

Business Description

Edenred was formed through the demerger and subsequent listing of Accor’s (AC) Services business in June 2010. It operates the leading digital platform for specific-purpose payments and related services, connecting >2m partner merchants with >1m corporate clients and 60m individual users worldwide (B2B2C). Edenred differs from universal payments companies like Visa and Mastercard in the sense that it pre-configures all aspects of a digital transaction (who, where, when, and how much), ensuring that these earmarked funds are used exactly as intended by a corporate or public client, and within an allotted timeframe.

The core model works as follows. First, Edenred designs a tailored solution for clients based on their requirements and loads the media. Edenred then receives cash for the face value of these funds and percentage commissions based on volume and the extent of voucher utilisation. These cards are then used within an affiliate network of partner merchants, who are reimbursed directly by Edenred and also send through commissions. So there is two-sided monetisation, with 2/3 of fees paid by merchants. Other forms of operating revenue unrelated to transaction volume might include gains on expired vouchers, fees based on user numbers, subscription revenues, etc., depending on the business line in question.

Edenred’s model is unique due to the time lag between when media are loaded and when merchants are reimbursed, producing a negative working capital requirement and generating float that can be invested in safe, liquid securities for an average period of about 7 weeks; this is akin to an insurance operation. Overall, then, the firm’s total revenue is split into operating and float revenue, with the latter rising or falling depending on the rates environment (now favourable).

The value proposition of this model for partner merchants, who typically accept cards from multiple issuers, is that it generates more one-off, and ideally repeat sales, and at a much lower cost than meal platforms like Deliveroo, Just Eat, etc.

For public authorities, Edenred’s services formalise part of the economy and support full employment. Employees gain additional disposable income, have a simplified mobility experience, can raise their quality of life, and benefit from a seamless corporate expense process, which can often be antiquated and impractical.

Lastly, corporate clients, who often select a single issuer brand, achieve more employee engagement, customised compensation packages, control over fleet ownership costs, and generally streamlined, efficient processes. Edenred’s contracts with large corporates are won through a tender process and have a typical duration of 1-3 years; contracts with SMEs are kept more flexible as order forms with general conditions.

Edenred’s largest business line is Benefits & Engagement (63%), where it offers >100 programs in 32 countries. It pioneered this field through Jacques Borel International and is the largest provider globally (40% share). Benefits & Engagement programs can take the form of meal and gift vouchers, health services, transport subsidies, awards and recognition, social events, etc. Flagship offerings are Ticket Restaurant, which allows employees to have lunch at a partner merchant (most popular in France), and Ticket Alimentación, which can be used to pay for groceries at partner supermarkets.

As part of its strategy, Edenred has sought to move Beyond Food; 31% of operating revenues in Benefits & Engagement are now unrelated to food (see Strategy). Recent acquisitions, such as Reward Gateway and Gointegro, are intended to expand the Engagement aspect. Benefits & Engagement solutions are exempt from income taxes as governments wish to encourage their use as an instrument of social policy, and though strict rules are in place, these should not be considered insurmountable for entrants.

The second largest line is Mobility (25%), through which Edenred helps companies optimise their fleet management. Edenred provides >90 programs across 30 countries, and is the leader in LATAM and third worldwide. Its programs generally help clients reduce their costs of ownership through levers like multi-network cards that minimise fuel prices, most-efficient route calculations, and the simplification of administrative tasks like invoicing and reporting. Clients in this line are split evenly between transportation and logistics companies and those which operate in other fields.

Though classic fuel cards account for the lion’s share of revenue (>70%), other solutions e.g., EV charging, fleet maintenance, tolls, etc., are contributing a growing portion of sales as part of Edenred’s Beyond Fuel plan. In the recent past, Edenred has sought to expand its European operation through strategic acquisitions; notable Mobility subsidiaries in Europe include UTA Edenred, which offers solutions for automatic electronic toll collection, fleet movement telematics, and widely accepted fuel cards, among others.

The final business line is Complementary Solutions (12%), which covers 60 programs in corporate payments, incentives and rewards, and public social work across 30 countries. Its payments services are the main offering; they enable more efficient B2B financial flows traditionally handled with checks and bank transfers. Edenred naturally leverages its expertise in earmarked payments to be at the forefront of this widespread digitalisation. Moreover, Edenred’s salary card solutions contribute to the financial inclusion of the most vulnerable employees: in the UAE, 1.8 million unbanked employees now have digital access to their salaries and basic financial services like insurance. In terms of public social programs, Cameroon has entrusted Edenred with the digital distribution of agricultural subsidies; this is a scheme where the threat of misuse is extraordinarily high, and for which earmarked solutions are perfectly suited.

Historic numbers show that Mobility solutions have the highest like-for-like (LFL) growth in the FY16-23 period at 16%, followed by Benefits & Engagement at 11%, and 9% for Complementary Solutions…

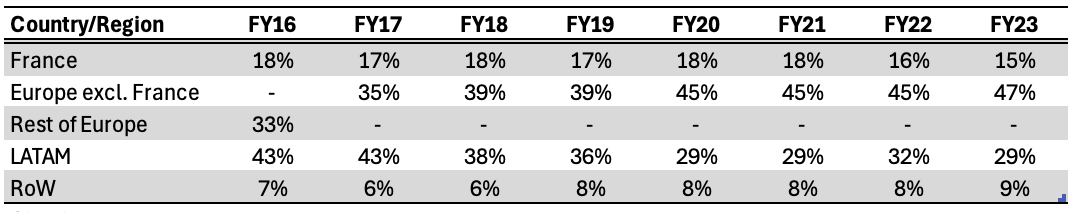

Geographically, Europe excluding France has grown fastest at 17%, followed by Rest of World at 14%, France at 7%, and LATAM at 5%...

On average, EBIT margins in LATAM are highest. But they have fallen recently, outshone by rising margins in Europe excluding France….

Edenred is most exposed to Europe excluding France at 47% of revenue, then LATAM at 29%, France at 15%, and Rest of World at 9%. Expansion in Europe appears to be in focus for management, with an increase in revenue share from 35% in FY17 to 47% currently…

Market

Edenred operates in extremely large markets that are under-penetrated, in particular for SMEs (rates as low as 5 to 10%).

For its older business lines of Benefits & Engagement and Mobility fuel cards, Edenred estimates penetration rates of 30% and 35%, respectively, and a mere 10% in Corporate Payment Services. The core (addressed) Benefits & Engagement market is sized at €300bn, Mobility at €1,700bn, and Corporate Payment Services at $10,000bn.

Importantly, these addressed markets are sized in terms of business volume i.e., the aggregate potential business volume of all companies eligible to grant employee benefits, whether they have done so or not. This is not the real commission revenue that can be won, which would be much smaller.

Under-penetrated markets typically offer lower customer acquisition costs (CACs), and Edenred has reported that its LTV/CAC ratios in Benefits & Engagement and Mobility are about 11x and and 10x, respectively, which is objectively excellent and highlights the favourable unit economics in this business.

Long-term growth drivers per business area are as follows…

Benefits & Engagement: economic formalisation, continued urbanisation, the emergence of the middle class, and an increasing contribution of services to the economy.

Mobility: more employee demand, optimisation of management, and a drive to minimise expenses and complexities.

Complementary Solutions: need for more efficient management of payables, incentives and rewards for employee retention, and public social programs to fight unemployment and tighten control over the distribution of subsidies whilst increasing the purchasing power of constituents.

The TAMs, which include non-core opportunities, highlight an even larger opportunity. Part of the reason for such extremely large TAMs are the relative ease and low cost with which Edenred can add new digital offerings into its portfolio (see chart below).

Competitors

In Benefits & Engagement, Edenred’s fiercest competitor is Pluxee (PLX), which was spun off from Sodexo and listed in Feb 2024.

Like Edenred, Pluxee began its operations in Western Europe and then expanded to emerging economies to become a global player. Pluxee claims 500,000 clients, 1.7 million merchants, and 36 million consumers in this space. Like Edenred’s, almost all of Pluxee’s solutions are digitalised, and it estimates global market shares in Benefits & Engagement at 40% for Edenred, 25% for itself, and 20% for Groupe Up, all in terms of business volume. Geogaphically, Pluxee derives 44% of its revenue from Continental Europe, 38% from LATAM, and 18% from Rest of World, with a current presence across 31 countries. More than 85% of its clients are SMEs. Pluxee’s model is almost identical to Edenred’s.

Financially, there is no marked difference between Edenred’s Benefits & Engagement line and Pluxee. A FY17-23 comparison of Sodexo’s Benefits & Rewards and Pluxee’s latest numbers with Edenred’s reveals that organic growth rates are 9% and 11%, respectively, though Edenred has done marginally better with an average reported growth rate of 10% compared to 6% for Pluxee (attributable to favourable FX and or acquisitions). EBIT margins are not comparable because Edenred does not disclose the profitability of its business lines, but we can use Pluxee’s margin as an indicator of Edenred’s Benefits & Engagement profitability (likely >30%).

In Mobility and Corporate Payment Solutions, Edenred’s main competitors are Corpay (rebranded from Fleetcor in March 24; CPAY) and Wex (WEX).

Corpay is a corporate payments solutions provider included in the S&P that specialises in the management of vehicle-related expenses, travel expenses, and payables. It boasts 800,000 corporate clients, 9 million consumers, and 4 million partner merchants. 57% of its revenue stems from the US with 43% internationally sourced. Its segments and their sales contributions are mobility solutions (53%), B2B payments (26%), and lodging (7%).

Wex is a similar, diversified provider of specific payments solutions, with revenue split between mobility (54%), corporate payments (20%), and benefits (26%). EBIT margins for Corpay and Wex fall in the range of 35-50%, which are clearly higher than those in the benefits business. This suggests that further expansion of Edenred’s Mobility and Corporate Payment Solutions lines would be margin accretive at the group level.

Unlike Corpay and Wex, Eurowag (WPS) exclusively competes with Edenred in Mobility. It offers pre- and post-paid payment solutions for energy and tolls through its payment solutions segment and SaaS for fleet, work time, transport management, etc., through mobility solutions. These segments contributed 57% and 43% of revenue in FY23, respectively. Eurowag’s EBIT margins have been low or negative recently.

Strategy & Guidance

Edenred’s strategic plan for the FY22-25 period, named Beyond, aims to make it the “everyday platform for people at work” in benefits and engagement, green mobility, and B2B payment solutions. It is designed to leverage Edenred’s unique platform, which can be split into digital experiences for stakeholders, business applications, digital services, and infrastructure.

The plan revolves around three pillars, with different attributions of expected operating revenue increases in the FY22-25 period…

Scaling the Core: growing further in core markets that are still under-penetrated through a segmented go-to-market approach and increasing monetisation (60% contribution).

Extend Beyond: launching more value-added services to accelerate the Beyond Food, Beyond Fuel, and Beyond Payments transitions (30%).

Expand in New Businesses: enter newer, attractive geographies like the US (10%).

All-in, the Beyond plan is to help create a total revenue base of €5bn by FY30, with 80% of that due to organic operating revenue growth. This implies a CAGR of 16.7% on FY23.

In the interim, group-level FY22-25 financial targets are…

Like-for-like (LFL) EBITDA growth of >12%.

Annual FCF/EBITDA conversion of >70%.

Management’s guidance has historically been conservative, with actual KPIs like operating revenue and LFL EBITDA growth typically a few percentage points ahead of official predictions.

Acquisitions

Inorganic growth through small acquisitions seems to be a popular strategy in Edenred’s industry. This is likely due to the synergies that can be realised through the elimination of duplicative overhead, the high upfront costs of developing a sophisticated software offering and reputable brand from scratch, and navigating the complexities of national regulations.

Below is a list of significant acquisitions in the recent past. It shows that Edenred has used this form of expansion in all its business lines, though with a slight bias towards Benefits & Engagement (its largest segment). At first sight, the recent 25x EV/EBITDA multiple paid for Reward Gateway in FY23 is not exactly attractive, even though the multiple drops to 20x if synergies are included. Reward Gateway’s performance and business quality is obvious though, with a 34% sales CAGR FY20-23 and a FY23 EBITDA margin of 48%.

A long-term analysis of acquisition spend since 2016 shows that of the €2.9bn cumulative spend on acquisitions, 52% went to Benefits & Engagement, 28% to Mobility, and 21% to Complementary Solutions.

Competitive Advantage

Edenred’s competitive advantage primarily resides in its network effects. With each new corporate client, partner, and user, its network becomes more valuable to its members, akin to a favourable cycle. This strongly disincentivises rational corporate clients from switching to other providers, even if the solution is technologically superior, which is unlikely in itself considering Edenred’s decades of expertise; the fact is that no corporate would provide its employees with a meal voucher or fuel card that has a minimal acceptance rate.

Edenred also benefits from economies of scale; it has several cost categories that are not fixed per se, but grow more slowly than revenue, creating operating leverage and allowing more attractive pricing. Finally, it is a benefactor of economies of scope through an ever-widening product suite. Its massive trove of data sourced from >1bn transactions annually provides a deep understanding of client needs, so new value-added services can be delivered at low development cost with more and more up-selling and cross-selling, creating one-stop-shop appeal for clients.

Altogether, unless an entrant can obtain the necessary financial resources, develop a package of solutions that is multiples better than Edenred’s, and do all this at a competitive price, chances of share gains are very low. Entrants will also lack Edenred’s ability to manage regulations, which it has developed over decades.

OpEx/Scalability

Edenred’s cost structure is primarily variable. COGS, which is undefined in reports, is least-correlated with sales growth (our best measure of output). In the FY15-23 period, operating revenue has outgrown total OpEx by 23% to produce a clear increase in operating EBIT margins from 27% to 30%, suggesting there is significant underlying operating leverage.

Management & Ownership

Insider ownership is negligible at 0.3% of outstanding capital. Bertrand Dumazy, appointed in 2015, occupies the dual role of Chairman and CEO. This calls into question the quality of governance, presents a clear conflict of interest, and introduces key person risk. This dual role was established by Edenred’s board in 2010, and it has been reviewed and renewed several times.

The rationale for this structure was commented on in the FY23 report:

“The single command structure and fast decision making and execution, resulting from the combined roles of Chairman of the Board of Directors and Chief Executive Officer, have enabled Edenred to establish itself as the leader in its markets for many years, setting it significantly further apart from its competitors. The Board of Directors believes it is essential that the Company maintains this momentum, especially in an increasingly competitive and technological environment and with a high turnover of Board members.”

Dumazy’s target compensation split as of FY23 looks as follows:

Financially, Dumazy’s compensation package primarily incentivises organic growth through LFL EBITDA (42%), but also inorganic growth through EPS excluding FX (13%).

Dumazy is a very well-paid CEO. FY23 total compensation came in at €5.4m, or about 57.4x the median compensation of an Edenred employee (no surprise there). It would definitely be a concern if Dumazy’s compensation continues to escalate from here.

Significant Risks

Market abuse penalties and spectre of more regulation in France. In Benefits & Engagement, Edenred occupies a leading position alongside a few other large players (oligopoly), and it has been punished in the past for collusion.

Specifically, Edenred and other large competitors in the French market were accused of exchanging information about their market shares on a monthly basis through the Centrale de Reglement des Titres (CRT), which centrally processes vouchers and merchant reimbursement; this discouraged aggressive pricing strategies as they would be detected quickly (no net benefit; Nash equilibrium). This same group was also locking smaller competitors out of the market by introducing strict, non-transparent admissions criteria to the CRT, denying them access to the cost advantage of centralised processing and a single point of contact for merchants. Edenred was allocated the largest fine of €157m (expensed in FY23), followed by Sodexo (Pluxee) at €126m, Natixis at €83m, Groupe Up at €45m, and the CRT itself at €3m.

On the opposite side of the market, regulator crackdowns are also encouraged by merchants, who have little bargaining power and complain that their fees are too high. As mentioned in the French Antitrust Authority’s recommendations to the government, merchant fees are about 4.5% compared to 0.5% for corporate issuers.

The main mitigator of this risk is Edenred’s global diversification, and the fact that, historically, fines tend to be quite small (the French one was an absolute exception).

Italian tender lawsuit. In May 21, Edenred won 4/15 lots in a €1.3bn total tender for Italy’s government procurement organisation Consip. This win would have corresponded to about €600m in business volume over 2-3 years. Repas, a small competitor with a 5% share, decided to sue Edenred for fraud in the tender process, and though Edenred won in the first instance, the case was appealed, and Edenred had to return one of its lots.

Then, in Feb 24, a criminal case was launched against Edenred related to this same incident, where the firm was accused of providing insufficient information. €20m was seized and placed into escrow, corresponding to the estimated revenue Edenred would have won under the tender. Notably, Italian law is unique in the sense that business lawsuits can also be criminal (Legislative Decree 231), which is, of course, a very undesirable buzzword in the press. Resolution of the entire case is expected in two years, and Edenred is “confident about its outcome”.

The wider concern is that fraudulent tenders are endemic to Edenred’s worldwide operations. However, this seems unlikely, primarily because the rules violated in this tender are specific to Italy. Moreover, all of Edenred’s employees are mandatorily trained in compliance and ethics, there is a whistleblower option, the firm has the highest anti-bribery certification available in Italy (obtained in June 23), and there are committees responsible for fighting risk and fraud in each subsidiary. Edenred has also not been accused of fraudulent tenders in the past, and it is still strengthening its internal procedures e.g., adaptation of audit trails, new risk matrix, etc.

Forex. Edenred operates in 43 countries but reports in Euros, hence there is FX risk. Because Edenred’s daughter companies transact entirely in their local currencies, this risk applies exclusively to dividends and royalties passed to the parent company. An assessment in the FY23 report claimed that a 10% change in the FX rates of the most important countries would increase or reduce profits by €20m in Brazil, €5m in the UK, and €4m in Mexico. FX risk is inherent to Edenred’s global business model and difficult to mitigate.

Data risks. The volume of sensitive data handled by Edenred requires the company to abide by data regulations and defend itself against cyberattacks. A leak could have serious reputational repercussions.

Entry of universal payments companies with massive networks. With their extant knowledge and greater resources, larger operators like Visa and Mastercard could present a big threat to Edenred’s market position. But the decades of expertise Edenred has acquired and the niche in which it operates might not be considered worth the trouble.

Interest rate risk. Whilst higher rates increase float income, Edenred also has floating rate debt that will become more expensive. Its cost of debt rose by 120 basis points FY22-23, for a total interest expense of €98m versus €31m. This is largely due to financing of the Reward Gateway acquisition.

Acquisitions. Risk of overpayment for an acquisition. Elevated due to the outsized acquisition of Reward Gateway. Mitigated by the LFL EBITDA growth incentive for Dumazy.

Key person risk. Dumazy’s dual role amplifies the effect of both good and bad decisions. Also, if he is a true driver of business success, his departure could lead to a losing stretch.

Recent Developments

French Antitrust recommendations and start of new regulations. The same authority that fined Edenred for locking up the French meal voucher market made five official recommendations to the government in October CY23, which are expectedly unfavourable for Edenred. These judgements are based on the high prices charged to merchants (up to 4.5% compared to 0.5% for issuers) and the extremely oligopolistic status of the French market, with less than 1% of it in the hands of smaller players.

The Authority recommends…

No price cap, as this is often creates a counter-productive benchmark for prices .

Generally stronger regulation of the sector.

Removal of each issuer’s exclusive right to accept the vouchers it issues.

Compulsory computerisation of vouchers.

More transparent prices for merchants.

The government figure in charge of meal voucher market regulation is the French Minister for SMEs and Commerce, Olivia Grégoire. Her reforms are expected by Jan 25. From public statements so far, she intends to fully digitise vouchers (currently at 60%, below other markets) by CY26 to reduce merchants’ costs and make the process less cumbersome. In fact, 1/4 of French restaurants refuse to accept vouchers due to these reasons.

Edenred’s Executive VP on Finance, Julien Tanguy, commented on the French situation in the FY23 AGM…

“She [the Minister] explained in the media that this long-term availability of vouchers would require involvement from stakeholders such as employees, employers, restaurants and also the issuers of the vouchers. The minister also announced that it would be made digital in France, that digitisation should come in, in 2026. That is very good news for us, seeing as we are already leaders of the digital market in France, and also leaders for restaurant vouchers.”

Dumazy also pointed out that the Minister sought to strengthen the meal voucher scheme in France, and that the market was still largely under-penetrated, with 25% of employees using vouchers compared to a potential of 50%.

On 1Q24 performance…

Operating revenue up 16.9% LFL YoY.

Statement that “Edenred takes the Italian case very seriously, leading to a strengthening of internal control procedures”.

Share buyback of €300m launched.

By line, Benefits & Engagement LFL operating revenue up 17.1%, Mobility up 23.2%, Complementary Solutions up 2.9% (disappointing).

More face value increases expected to counter inflation.

Reformation of tender process initiated.

Valuation

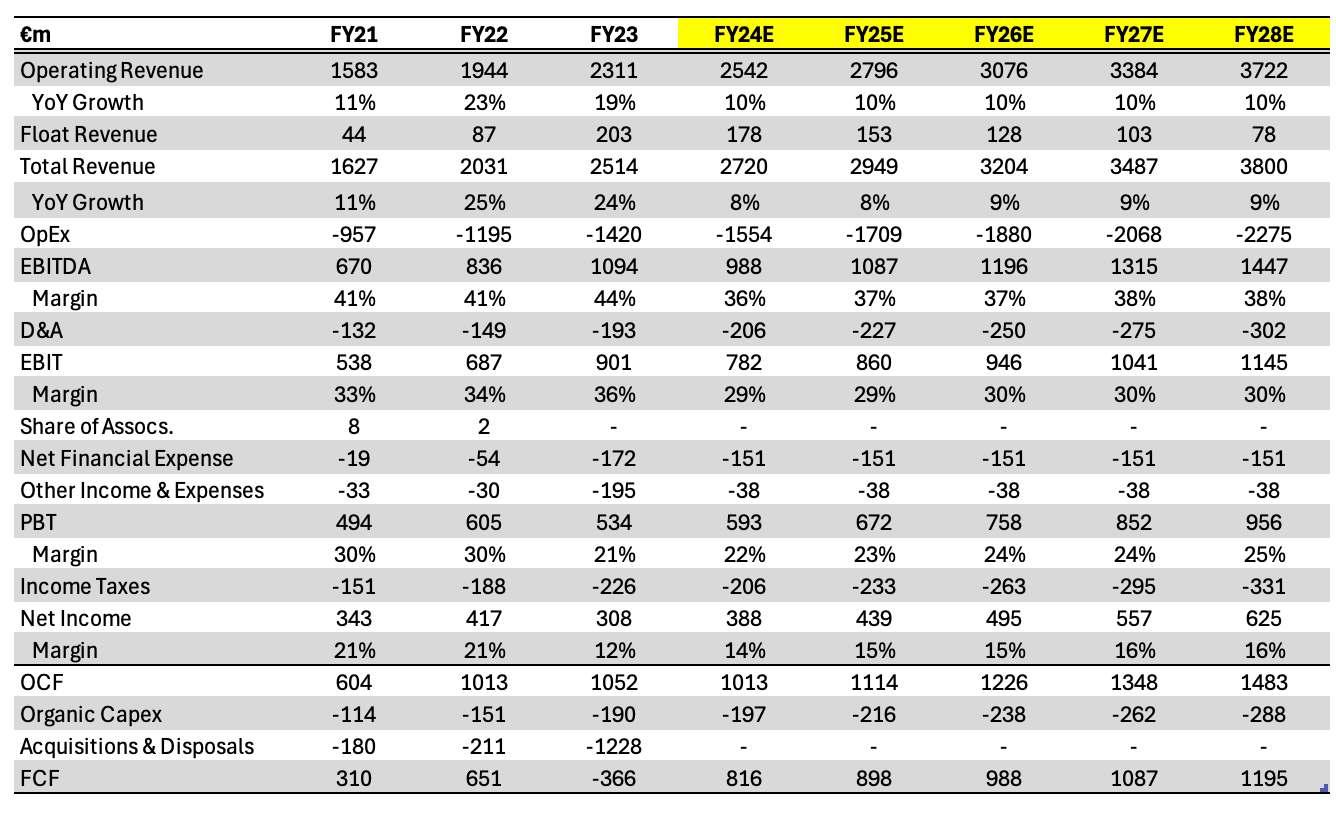

Because of Edenred’s full and reliable cash conversion, it makes sense to construct a simple 5-year P&L, and then bridge to OCF and FCF from EBITDA. If float had been reported by region, it would have been possible to calculate operating EBIT and margins alone, which would have allowed for a more detailed forecast, in particular for France e.g., we could have assumed stable revenue and declining margins to account for more regulation. However, this is not the case, so an overall organic revenue forecast must suffice.

Crucial forecast assumptions include:

10% growth rate in operating revenue based on historical performance, which leaves room for €500m in additional revenue from acquisitions to hit the €5bn guidance by FY30;

A fall in annual float revenue of €25m until it roughly hits the pre-COVID period (no reliable estimate possible, but this is a small item);

OpEx and D&A at 3-year averages of operating revenue; net financial expense stable at €151m (cost of debt of 3.6% applied to €4,200m gross debt with long maturities);

Absolute 3-year average of other income and expenses at €38m;

3-year averages of effective tax rate, capex/sales, and cash conversions.

This conservative forecast is roughly in line with Edenred’s guidance of 12% LFL EBITDA growth and Pluxee’s target of low double-digit revenue growth, respectively.

On these numbers, and with a 8.1% WACC and 15x EV/EBITDA exit in Y+5 (5-year average backward multiple, very similar to median), the price target is €70, for an upside of 76%.

Conclusion

The quality of Edenred’s business is indisputable, but a judgement must be made on whether the price is attractive when considering the probability of stronger regulation in France in the future and the possibility of problematic tenders being endemic to the firm.

A good argument can be made that the risk-reward tradeoff here is favourable. First, the recent fine and regulatory scrutiny is localised to France, which accounted for 14.8% of total revenue and 12.5% of total EBIT in FY23 and is very unlikely to be decimated entirely with new regulations (though growth and or profitability would perhaps be lower). With its agile model, Edenred can flexibly refocus on other regions.

Second, the concerns about fraud within the company seem to be more than priced in if we consider that there have been no high-profile allegations of this type against Edenred in the past, that the maximum penalty for a (hopefully) one-off incident has been paid, that the violation was specific to Italian rules, and that the first ruling was favourable. Moreover, the firm has broad compliance procedures in place, which are being strengthened further. Since the news of the Italian case was released, Edenred’s market cap has dropped from €14.1bn to €10.1bn, for a €3.9bn loss. Of course, this is also due to fear of French regulations. Regardless, this seems excessive, and the potential upside on these conservative assumptions should provide enough of a margin of safety. I expect the stock to move primarily with the announcement of the French regulation package in the next few months and updates on the Italian case, alongside consistent fundamental performance.

Disclaimer: this write-up describes the author’s own research and opinions, and does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I hold a material position in the issuer’s securities.

Hi Johan, thanks for the detailed analysis. What is the likelihood of using that float to grow into a mini-Berkshire? And what is the likelihood of transforming into a super app?