Dedicare (DEDI)

The Nordic region's largest provider of temporary healthcare and social work staff.

Investment Case

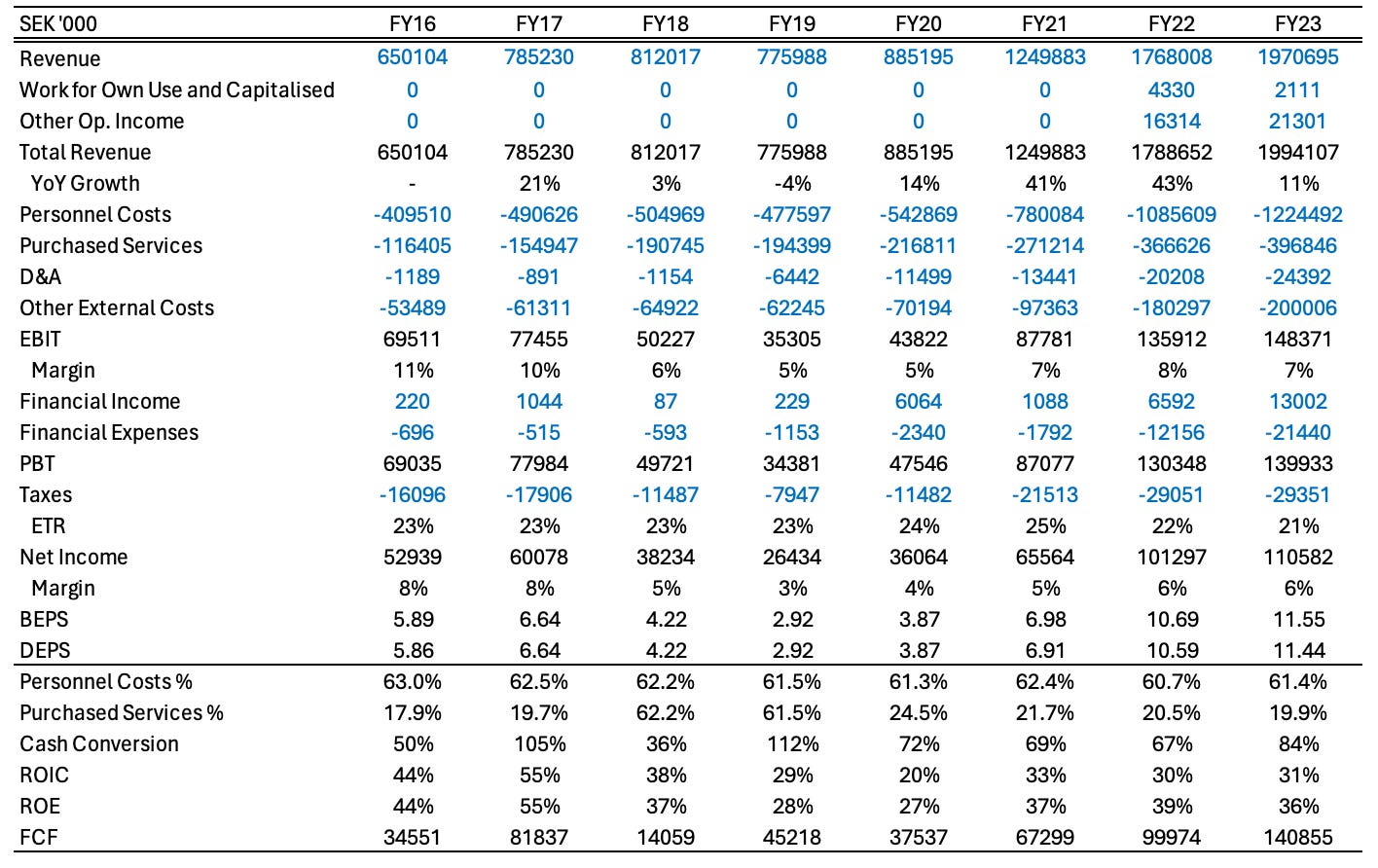

Attractive financial profile. Dedicare has a long track record of revenue and EBIT growth, with respective CAGRs of 16% and 26% since FY13, though the Swedish segment is certainly a letdown. However, the fact that this segment at least does not shrink and that its share of sales will continue to decrease as other segments grow is encouraging. Dedicare's model is also capital light and OCF/EBITDA cash conversion has averaged around 75%. Respective ROIC and ROE averages are around 35% and 38%, which points to excellent capital allocation (and efficiency). The firm is also somewhat insulated from economic upswings/downswings due to its exposure to healthcare, where demand is relentless. This is evident from its historical revenue trend (also see the FY17 five-year overview).

Growing market with expansion opportunities. Top-heavy demographics, rising costs, and an acute shortage of healthcare professionals in Europe are likely to ensure strong demand for agency staffing in the future, though there is no consensus as to whether temporary staff are truly cheaper than permanent employees. The limiter on this growth will be new or more stringent governmental regulations, such as caps on the percentage of overall personnel expenses allocated to staffing, as seen in Sweden for FY23. If, and the degree to which these policies will enter into force in other segments/markets in the future is hard to predict. Diversification across different national markets, which Dedicare has successfully demonstrated in the past (it started in Sweden), is the obvious solution. Given historical revenue growth and the 10% forward guidance, it does seem that market drivers outweigh the impact of regulations for now. The valuation also indicates that this risk is more than priced in.

Business Description

Dedicare is the Nordic region's largest provider of non-permanent (and to a far lesser extent permanent) qualified staff to healthcare, social work, life sciences, and preschool organisations, with operations in Sweden (SW), Norway (NW), Denmark (DK), and the UK. Its value proposition to consultants is that it offers them the flexibility to choose when, where, and how much to work. The benefit for clients - almost all of whom are regional health authorities and municipalities - is a quick source of trained labour that can compensate for periods of peak demand, vacations, and sick leave, and which might permit the performance of infrequent, specialised procedures. It also turns what would otherwise be a fixed personnel cost for clients into a variable one, adding financial flexibility.

Generally, across segments, staffing contracts are won through public tender, where Dedicare and its competitors compete to offer the lowest price to clients (the critical criterion), who usually hire multiple providers. The typical duration of these framework agreements is two years, with a possible extension of the same length, and though the duration of contracts is quite short, renewal rates for Dedicare are very high at >95%.

All of Dedicare's consultants i.e., the staff it sends to clients on assignments, have collective bargaining rights, and therefore have access to benefits like pensions and insurance, which makes Dedicare a more attractive, authorised employer. This is important if we consider the pervasive skills shortage in healthcare. However, those firms that are unauthorised have free rein to offer their consultants higher salaries or charge clients lower prices, which can cause imbalances in the market and heighten competition. Dedicare actively lobbies regulators to prefer authorised providers in public tenders in order to enhance its own position.

As to the staffing process, consultants' details, experiences, and availability are registered in a central database. Consultants' managers - often qualified nurses and social workers themselves - use this record to match staffers to clients' assignments within one hour, as speed is of the essence. Most of these assignments are cross-border, and their durations can range from hours to months. Dedicare might send one employee or staff an entire unit. It bears full employer responsibility for its consultants and leaves clients in charge of operations. Doctors tend to work through their own companies when staffed and then invoice Dedicare for their services afterwards.

Staffing is normally a low-margin business as a result of no barriers to entrance and the commoditised nature of the consultants provided. Moreover, because staffing is a method to control costs, the client base also tends to have tight purse strings and there is almost no pricing power for providers. Differentiation through specialisation can raise margins (as in the case of Amadeus FiRe), as can a severe shortage of labour like that found within European healthcare and social work.

An absence of moats means efficiency is of the utmost importance, as this is how the lowest prices can be offered to clients in public tenders. Dedicare's own model is very capital light, but most costs are variable and rise with business volume, so there are no economies of scale, as much as this does permit flexibility and mitigate the risk of sudden, downscaled orders. Dedicare's average ROIC and ROE are 35% and 38% FY16 to FY23, with Sales/FTE up from SEK1.28m to SEK1.5m in the same period. These metrics highlight excellent capital allocation and efficiency.

Specific Markets/Segments

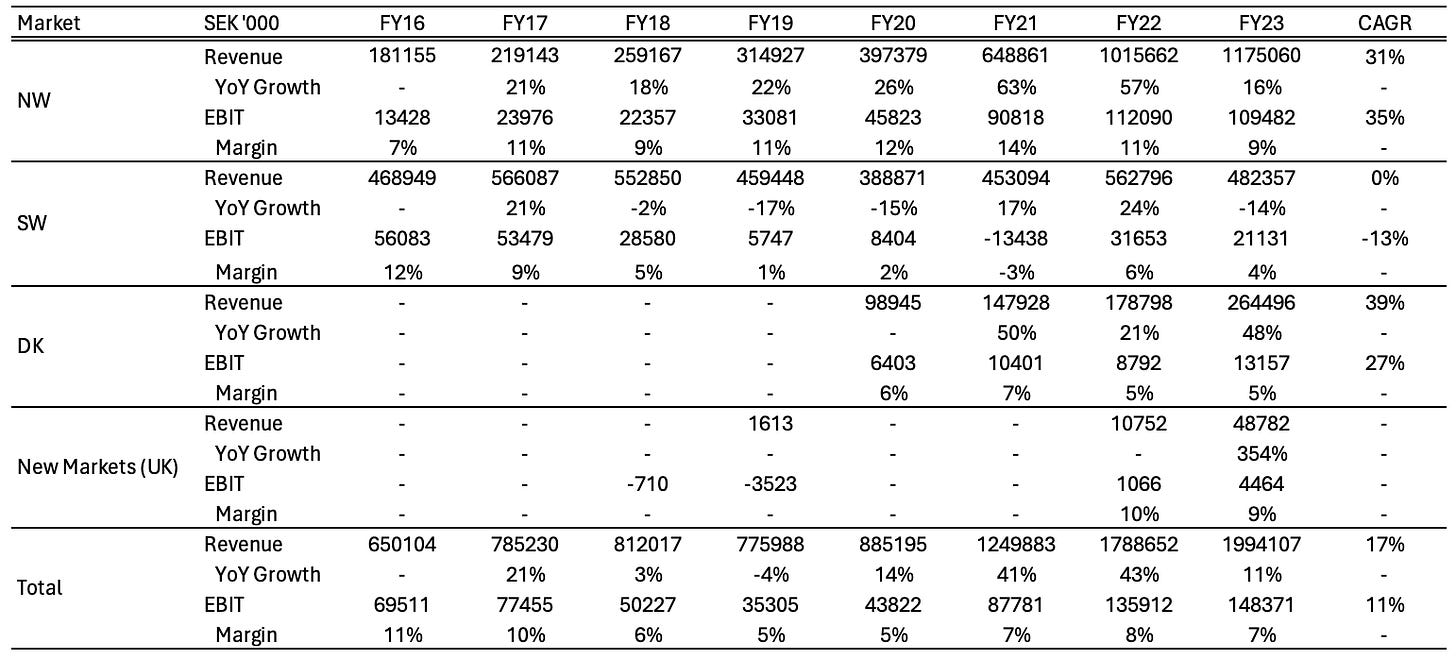

In NW, Dedicare offers healthcare, social work, life sciences, and preschool professionals (the entire spectrum of services). NW has become Dedicare's largest segment and its profitable growth engine, with 93% of its clients being public and 7% private. The regional healthcare authorities have a centralised procurement organisation that makes decisions for all, and the largest customer is the South-Eastern authority, which contributed 10% of NW's sales in FY23. The Norwegian market is sized at SEK4.2bn with around 50 competitors, half of which are authorised (allow collective bargaining). 50% of the staffing market consists of nurses, 30% of doctors, and 20% of social work and other types.

In SW, Dedicare provides healthcare, social work, and life sciences consultants. This segment has not grown at all and has the lowest profitability. Sources of trouble in the past have included higher salaries for consultants due to the labour shortage, a market contraction within social work, competition, and consequent margin pressure. Moreover, legislative changes have been unfavourable, such as the government's recent decision to limit the proportion of external healthcare staff. But demand is still there, with a SEK38bn four-year deal signed in CY24 that will run until CY28. The annual market is sized at SEK9.3bn, and of the 90 competitors, 1/3 are authorised. The split of staff types in this market is 53% doctors, 44% nurses, and 3% other. 76% of clients are public with 24% private and SW's largest customer was the Stockholm region, at 9% of the segment's sales.

In the SEK2.4bn Danish market, Dedicare exclusively provides long-term (>6 months) staffing in the healthcare and life sciences spaces. 98% of its clients here are public. Like NW, DK has also grown at a fantastic rate of 39% since the segment’s creation in FY20 and with decent margins, but at the cost of significant exposure to the largest customer, the Jutland authority, which accounted for 32% of FY23 sales.

In the UK, which was entered through the acquisition of Templars Medical, healthcare staffing is almost entirely handled by the NHS, and it is unsurprisingly the largest market in Europe at SEK43bn. Around half a dozen rivals dominate the market, but there are hundreds of competitors. Dedicare's consultants here operate exclusively in healthcare. Revenue exposure to King Edward's hospital is extreme at 59%, but the overall New Markets revenue base is thankfully very small. All customers are public.

M&A

Dedicare has partly grown through acquisitions, which it seems to use to establish an initial foothold in new markets. For example, the purchase of KonZenta in FY20 created the DK segment and Optical Medical formed a UK branch. Multiples paid seem reasonable, and considerations are mixed in the form of cash, shares, and contingent components.

Overall Market & Drivers

The largest three markets for temporary healthcare staff in Europe are the UK (40%), France (13%), and the Netherlands (12%), as part of a European TAM of SEK66bn in 2018 (Dedicare's estimate).

Dedicare has several business drivers…

Aging population, demographics to become more top-heavy.

Acute shortage of healthcare staff.

Rising costs due to greater patient demands, higher staff salaries, etc.

Strategy & Guidance

Dedicare has five strategic focus areas, each with their own KPI targets.

To be an attractive employer for core staff: NPS ≥50 and commitment index ≥4.

Attract consultants through a diverse set of interesting and cross-border assignments: consultant satisfaction ≥9/10.

Develop its business reach through new customers, categories, and markets: enter one new geographical market or customer segment per year.

Deliver customer and social benefits: customer satisfaction ≥9/10.

Dedicare has generally hit or exceeded these targets in past years. Its mid-term goal is to grow sales by at least 10%, with an average EBIT margin ≥7%. The target equity/assets ratio is 30% and the payout ratio is 50%.

Public Comps

There are no perfect comps for Dedicare. Other firms operating in recruitment and staffing either have much lower EBIT margins, such as Adecco Group, Randstad, and Robert Walters, or premium margins, like Amadeus FiRe and Ogunsen. Moreover, none have a similar degree of exposure to healthcare and social work. This makes a financial comparison and relative valuation less useful.

Risks & Mitigants

Dedicare is certainly not without risks, which must be considered when reflecting on the valuation.

Policies that aim to reduce dependence on external staff; these require flexible adaptation to downscaling through a variable cost base and diversification across international markets. The issues that these can raise are best seen in the performance of the Swedish segment.

Inability to attract and retain qualified consultants, which is critical due to skills shortage. Salaries might rise and when combined with the lack of pricing power could squeeze margins, which demands a focus on consultant satisfaction and an ever-wider range of attractive assignments.

Customer concentration, in particular the 1/3 dependence on Jutland in Denmark; this is best mitigated through expansion into new geographies and business segments.

Dependence on winning big, infrequent tenders again and again; this risk calls for constant efficiency and excellent customer satisfaction.

With net cash of SEK119m and interest coverage of 8.1x, there is no balance sheet risk.

Ownership & Management

Dedicare has a dual share class structure: Class A shares have one vote (1:1) and it takes five Class B shares to win the same influence (1:5). Both have full economic rights. Insiders, of course, hold all of the Class A shares. Specifically, the founder and Chairman, Öras, holds 27% of the capital and 38% of votes both directly and indirectly, and Pizzignacco (Board Member and Head of HR) holds 12% of the capital and 29% of votes.

The CEO holds warrants for 60,000 shares and is incentivised primarily with an annual bonus between 0% to 80% of base (exact targets unknown). He was paid roughly €542k in FY23. The CFO holds no shares at all.

Valuation

At its current valuation, Dedicare trades at an 11% FCF/EV Yield based on the average of the past three years - keep in mind this is a firm growing at quite a respectable rate. In a status quo scenario, I believe it is worth SEK105, or roughly where it trades now. This also leads me to believe that future regulatory risks to growth are more than priced in.

Including growth with a simple DCF based on guidance, averages, and typical cash conversion, the firm is worth about twice as much, at SEK172. This assumes a truly conservative 6x EV/EBITDA exit multiple in FY28E.

Conclusion

The primary cons of this investment include fierce competition, no true competitive advantages, poor executive incentives, and risk from regulation, in particular in NW and DK. However, I believe that the conservative estimate of an 11% FCF Yield (a three-year average for a growing firm) more than makes up for this, as do the strong drivers of the overall healthcare staffing market. Insider ownership is also high, and Dedicare is the largest player in the Nordic region, with a >95% renewal rate for contracts, suggesting it has strong business continuity. The cash flow is excellent and so are the returns on capital.

Disclaimer: this write-up describes the author’s own research and opinions, and does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I hold a material position in the issuer’s securities.