Quick Pitch: Condor Gold (CNR)

Fully-permitted, open gold pit with between 2.6x (minimally) and 9.5x maximal upside on NPV net of liabilities, almost two-years into an ongoing sales process...

This is a shorter format pitch for a rather simple (and perhaps timely) case.

“We are very aware of the value of our assets and will not allow them to go at anything other than a fair price.”

- Jim Mellon, Chairman

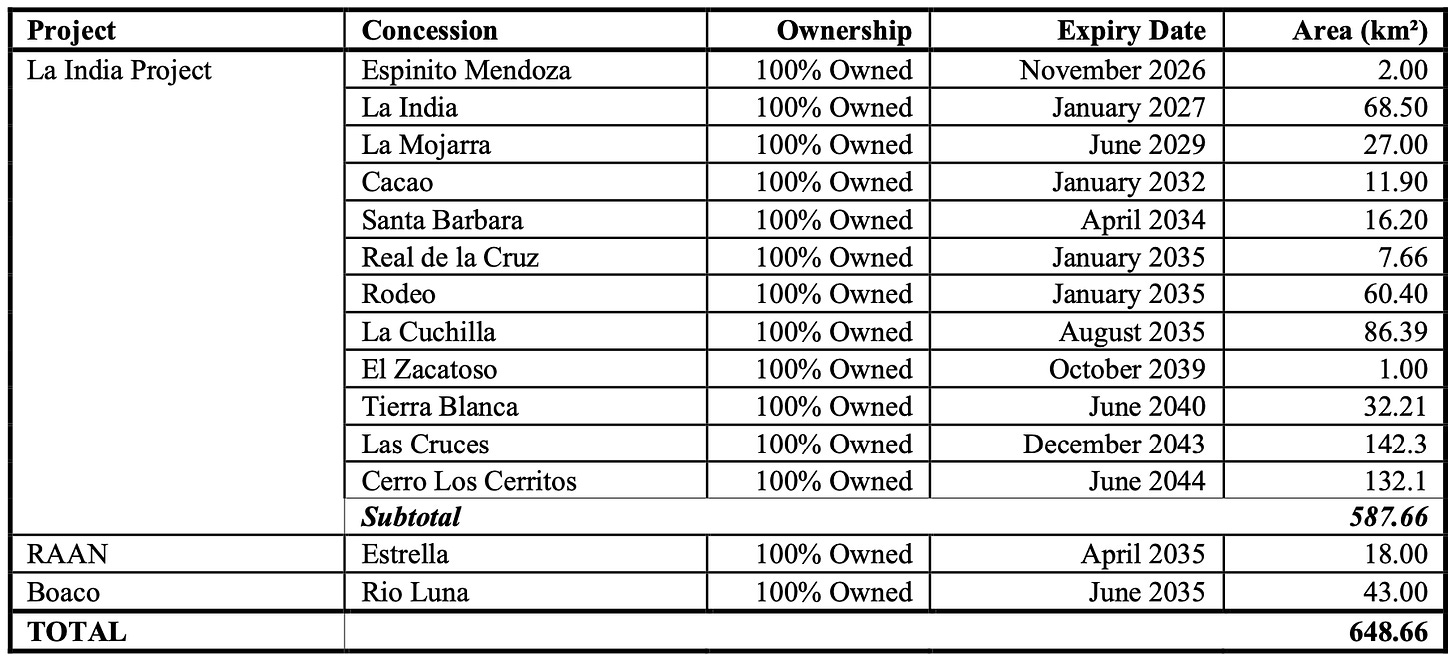

Condor Gold (CG) is a small gold exploration and development firm with operations in Nicaragua, Central America. Its prized (and sole) asset is the wholly-owned and fully-permitted 588 sqkm La India package, acquired in FY10, which includes 12 of its 14 exploration and exploitation concessions (others are Estrella and Rio Luna). Eight of these were granted by the Nicaraguan government, with the remainder acquired. La India is a historical gold mining district, with successful industrial-level extraction having occurred in the mid-20th-century.

Under Nicaraguan law, concessions last for 25-years and exploration must be initiated within 4-years. Holders need an environmental permit, and concessions can also be renewed for the same duration provided six-months notice are given and the relevant laws are adhered to. 1% of any concessions must be made available to artisanal miners who cannot use mechanised techniques or back-hoes. The corporate tax rate stands at 30% and there is a net smelter royalty of 3% plus another 3% royalty for Royal Gold (applies exclusively to La India), though La India and two other concessions are exempt from Nicaraguan surface tax as they were acquired under a previous legal framework.

Gold is Nicaragua’s highest-value export, at $1.2bn in FY23, and the country is considered miner-friendly: it allows repatriation of profits and has a solid legal framework in place to attract foreign investment. Metallic mining concessions cover 15% of Nicaragua’s land area, with Calibre Mining being the biggest player, both in terms of export share (36%) and concessions held (9% of the country’s area). >70% of Nicaraguan gold goes to the U.S.

In Oct 21, CG published a speculative Preliminary Economic Assessment (PEA) which unfurled the potential of the La India concession in two scenarios. Scenario A assumed that mining would be conducted from four open pits: La India, America, Mestiza, and CBZ, at a plant feed rate of 1.225 mtpa. Scenario B extended the mining activities to include three underground operations at La India, America, and Mestiza, for an elevated feed rate of 1.4 mtpa. At a 5% discount rate and $1,550/oz price, Scenario A suggested an NPV of $236m versus $313m for Scenario B. Completion of this PEA meant that seven Mineral Resource Estimates (MRE) had been completed for CG’s portfolio, plus another Preliminary Feasibility Study and PEA.

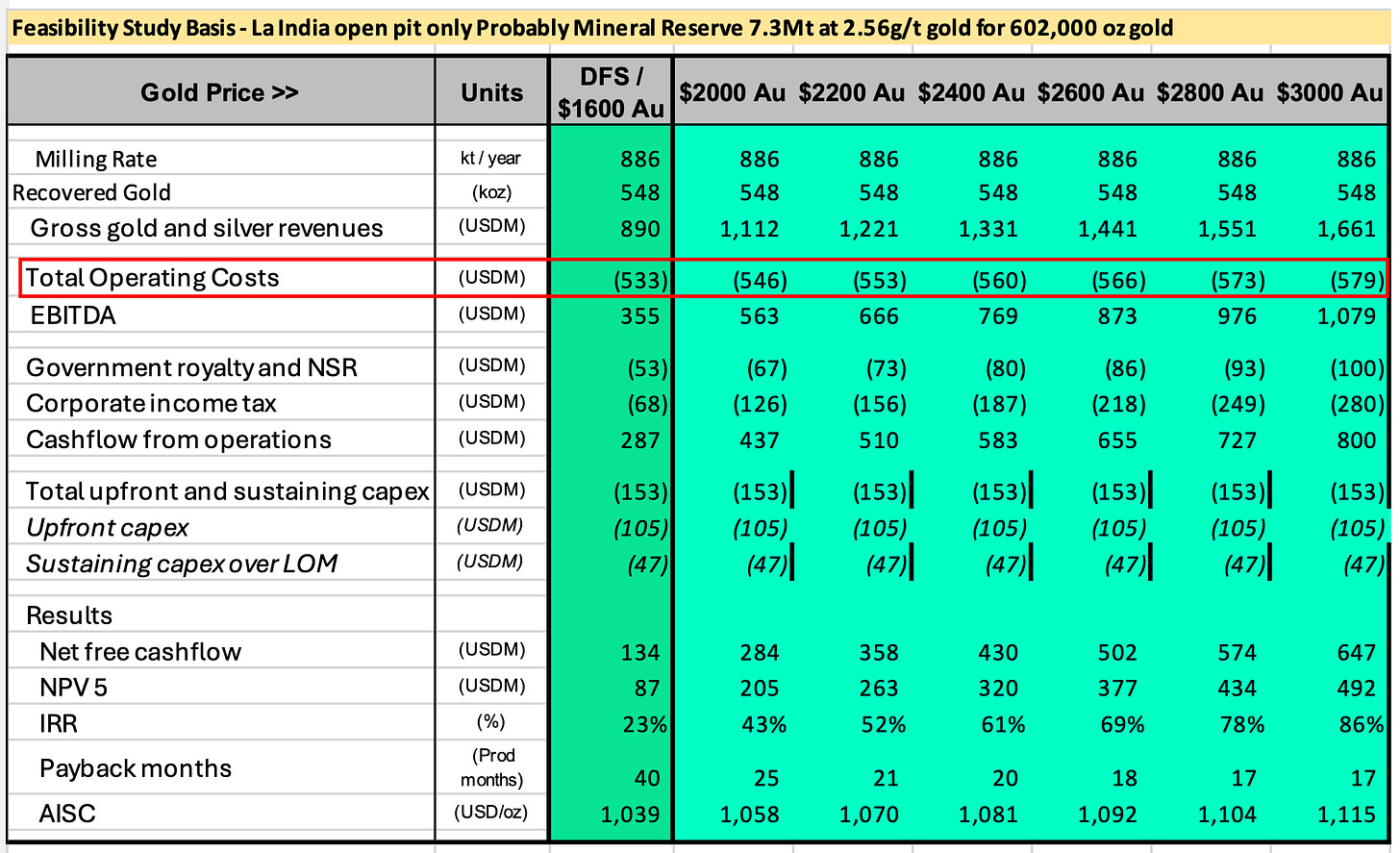

In Oct 22, CG moved past the speculative PEA to release a more credible direct feasibility study (DFS) for the La India open pit alone. This indicated potential for 7.3 mt in minerals at 2.56 g/t and 602,000 oz of gold in total, classified as probable reserves (one step below proven). This probable mineral reserve was estimated at being within 250 metres of the surface, qualifying as entirely extractable through open-pit mining. At $1,600/oz, which was almost exactly the spot price in that month and year (might suggest delta would not be large between the sales price and spot), the post-tax NPV for the La India open pit alone was $87m, for an IRR of 23%. Such a mine would be expected to produce 81,545 oz annually in the first six-years of an eight-and-a-half-year life, with $106m in upfront capex required and all-in-sustaining costs of $1,039 per oz. The development timeline would be 18-months.

In Nov 22, CG appointed an investment bank to sell the La India package.

Of course, the aforementioned price of $1,600/oz in the DFS does not even approach the spot price of $2,500/oz today. This is crucial to consider, because costs are almost entirely fixed in this case of extraction, which creates massive operating leverage that leads NPVs and IRRs to shoot up with higher prices (see screenshot).

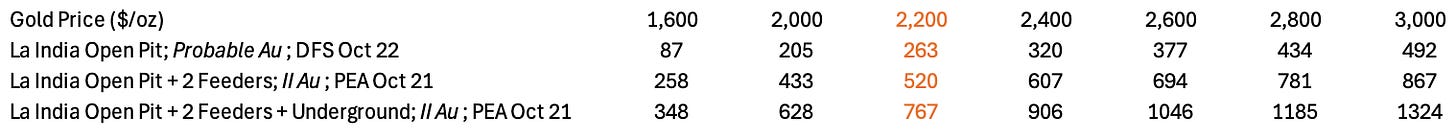

That being said, in the table below I compare the NPVs of three extraction scenarios as prepared by CG in the FY23 investor presentation: La India open pit, the latter plus two feeder pits (a most likely development), and the latter two plus underground exploration. “II” means indicated and inferred, and CG used a 5% discount rate to reflect the low risk for a buyer thanks to its continued development of the sites.

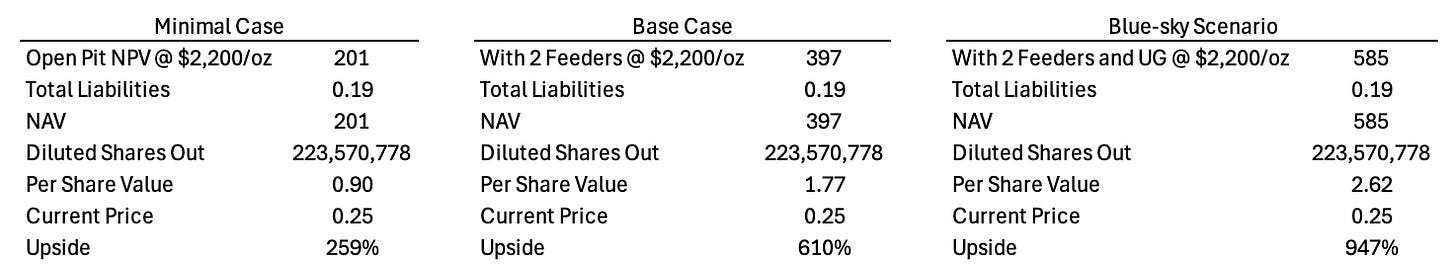

When it comes to CG’s valuation, certain things are clear. First, whoever acquires the package will likely sell below the spot price for various reasons, including the fact that it fluctuates in itself and is unpredictable. Second, the bankable DFS is most reliable and should be used as the minimal upside case, since reserves here are classified as probable (>50% at the low end, up to 90%), as opposed to indicated and inferred (<50%). Third, we should expect a discount on per share value due to country risk.

In line with these caveats, I assume a spot price of $2,200/oz applied to the three different scenarios: open pit, open pit with feeders, and the latter two plus underground exploration. CG has negligible liabilities, with £190k in payables, and I ignore the £2m in cash in case the sales process takes longer. This points to 2.6x upside under the base case, 6.1x under the feeder scenario, and 9.5x in a blue-sky outcome.

The sales process for CG’s assets has taken longer than expected:

Nov 22: announcement of sales process.

Mar 23: nine companies under NDA.

Jul 23: eight companies under NDA, five non-binding offers received and three site visits completed.

Dec 23: eight companies under NDA, still counted five non-binding offers and three site visits, in advanced discussions with two producers. No firm proposals.

Jul 24: eleven companies under NDA. Five non-binding offers and three site visits. Formal expression of interest received in past weeks.

Actual reports provide no further context as to what is going on behind the scenes, though it is understandable that after more than a decade of unprofitable exploration and dilution, management wants to ensure it gets a fair deal for its efforts.

Regardless, the longer it takes to sell the assets, the more cash burn and dilution for investors. This is a zero-revenue exploration firm, and dilution is definitely expected, if not through raises then through stock grants. Salaries and wages in FY23 totalled £585k (including a modest £200k to Mark Child, the CEO), and there is also the ongoing cost of compliance with regulations e.g., the environmental permit, which demands local investments. Actual cash burn was £1.4m in FY23, with £2m in cash on the balance sheet.

Jim Mellon, who owns 26.1% of stock worth £13m at current prices (but multiples of this post-sale), is a shrewd businessman and billionaire living on the tax-friendly Isle of Man, and in the case of low demand, he is the ultimate backstop for CG’s balance sheet until the sale.

Just look at the structure of the last five significant capital raises/option grants:

June 24: £220k raised at 22p in exchange for 1m new shares. 300k went to Jim Mellon, with 100k each to Mark Mellon (CEO) and another director, others sold in the market.

May 24: Jim Mellon exercised warrants at 15p for gross proceeds of £500k and 3.3m of new shares.

Dec 23: £1m raised again through Jim Mellon exercising warrants for 6.7m in new shares, plus a separate raise at 15p for 5.7m new shares.

Jul 23: £1m raised by Mellon through warrants at 15p for 6.7m in new shares.

Dec 22: £3m in gross proceeds from a rights issues, Mellon provided 1/3.

On liquidity, management stated the following in the FY23 report:

“The Directors have prepared a cash flow forecast for the going concern period (up to 30th June 2025), demonstrating the austerity measures including a reduction in salary costs, deferment of fees, and reduced overheads, which can be implemented to reduce the Group and Company’s cash outflows to the minimal contracted and committed expenditure while also maintaining the Group’s licences and permits.”

The situation, then, is as follows:

All of the firm’s value lies in the La India package; tangible book value per share is a fraction of the current price.

The gold price is rising and at the highest point in the past five-years (and ever, though this is expected) which results in far higher NPV and might not persist.

Insiders like Jim Mellon (26.1%) and Mark Child (2.4%) are invested in the biz and therefore actively disincentivised to dilute: every quarter longer it takes to sell, the more cash they burn, and the more they have to put up to maintain their stake.

With austerity measures, dilution is likely to be lower in the next year.

We are one quarter away from being in a two-year sales process. The three-year mark would definitely be pushing it.

Of course, despite the multi-bagger potential, this investment is definitely not without risk.

Besides the fact that all of the firm’s value stems from its La India package (no downside protection), samples in the MREs do not guarantee an extractable resource, even if they are classified as probable. Reassurance comes from the multitude of MREs that have been conducted on these sites over more than a decade, and historically profitable mining operations in this same area.

There are also country-specific risks, like recent (but not enforced) sanctions placed on Nicaragua by the U.S. (biggest importer of Nicaraguan gold) due to Daniel Ortega’s oppressive and authoritarian acts. Whilst CG received legal advice that these sanctions would not impact its own operations, likely because it has no financial ties to the U.S., unfavourable legislative changes still cannot be ignored, even though Nicaragua is considered friendly to miners and through its export business is incentivised to be accommodative. One should not be naïve: gold mining has always been dirty, and Nicaragua has been involved in significant controversies. These include the theft of indigenous lands and a suspicious mismatch between official gold exports and actual sales abroad.

CG has made good on its own environmental permit obligations, doing things like providing water to local communities and other donations, and has taken the responsible path. But I assume most of the controversies stem from actual mining instead of far lower-impact exploration and development. Construction by a buyer of La India will likely require 1,000 workers, primarily Nicaraguan nationals, and the upfront capex of $106m also flows to Nicaraguan contractors.

“The current stated strategy of the [Nicaraguan] government is to double gold production again in the next 5-years. So they’re very pro-mining, you get to own 100%, they haven’t changed the mining law. […] They don’t have oil, and see this is a cornerstone of the economy.”

- Mark Child, CG CEO

It is very likely that Chinese buyers would be less concerned about these risks than Western companies; they might demand less of a discount.

A drop in the gold price would reduce the NPV as quickly as it rose, but a comment on the macroeconomics at play here would probably add no value. It is also possible that the asset is not sold for whatever reason i.e., a sale is not a foregone conclusion, though this seems very unlikely given the clear interest.

To conclude, CG is an asset play with multiples of the current share price in upside, even on the conservative side. There is reason to believe that the La India package will be sold within the next few quarters or year, at minimal dilution to shareholders (restricted expenditures), to take advantage of the high gold price. I cannot for the life of me understand why someone as rich as Jim Mellon would be involved with a small gold exploration firm like CG given his others interests if the upside was not as big as it is. This seems like a story of repeated excitement and disappointment over the course of a decade, with now being the chance to get in to seize the cherry on top, minus the sweat and toil. Even the capitalised development assets are classified as held for sale. I was unable to find any prior write-ups on this firm.

“There remains substantial interest from gold producers to acquire the Company’s assets. Wholly-owned, fully permitted, construction ready gold mines with potential production of 150,000 oz gold per annum, in major Gold Districts, with the land and a new SAG Mill package purchased and a construction period of only 18-months are rare. There are currently eleven companies under NDAs, five non-binding offers received and three site visits completed. Whilst discussions have ceased with one gold producer previously referred to, the Company is now focused on active discussions with three other gold producers, one of which we consider the preferred bidder.”

- Jim Mellon, Chairman CG

Disclaimer: this write-up describes the author’s own research and opinions. It does not constitute investment advice, whether explicit or implied. Invest at your own risk and do your own due diligence. I do have a position in the issuer’s securities.